(Departmental rates) The Houston Custom Tile Corporation has two depart ments: Mixing and Drying. All jobs go...

Question:

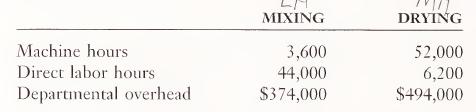

(Departmental rates) The Houston Custom Tile Corporation has two depart¬ ments: Mixing and Drying. All jobs go through each department, and the com¬ pany uses a job order costing system. The company applies overhead to jobs based on labor hours in Mixing and on machine hours in Drying. In December 1997, corporate management estimated the following production data for 1998 in setting its predetermined overhead rates:

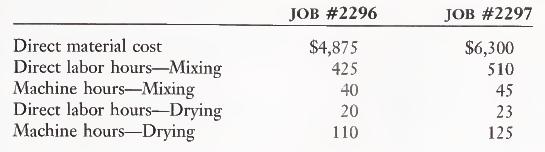

Two jobs completed during 1998 were #2296 and #2297. The job order cost sheets showed the following information about these jobs:

Direct labor workers are paid $9 per hour in the Mixing Department and $22 per hour in Drying.

a. Compute the predetermined overhead rates used in Mixing and Drying for 1998.

b. Compute the direct labor cost associated with each job for both departments.

c. Compute the amount of overhead assigned to each job in each department.

d. Determine the total cost of Jobs #2296 and #2297.

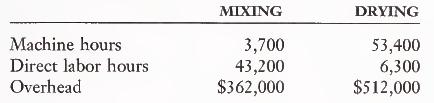

e. Actual data for 1998 for each department is presented below. What is the amount of underapplied or overapplied overhead for each department for the year ended December 31, 1998?LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney