(Comprehensive; multiproduct) Greenbacks Flooring makes three types of artificial turf: astro, golf, and lawn. The companys tax...

Question:

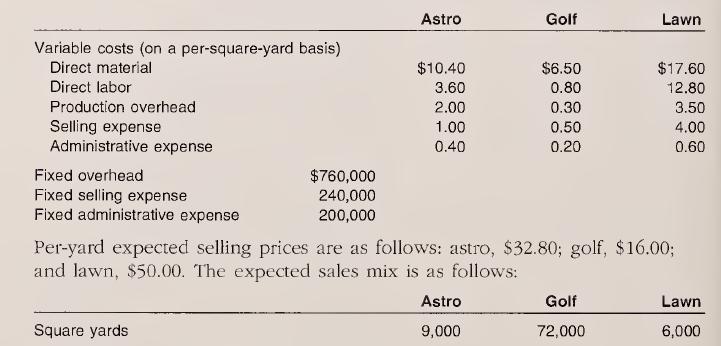

(Comprehensive; multiproduct) Greenbacks Flooring makes three types of artificial turf: astro, golf, and lawn. The company’s tax rate is 40 percent.

The following costs are expected for 2006:

a. Calculate the break-even point for 2006.

b. How many square yards of each product are expected to be sold at the break-even point?

c. If the company wants to earn pre-tax profits of $800,000, how many square yards of each type of turf would it need to sell? How much total revenue would be required?

d. If the company wants to earn an after-tax profit of $680,000, determine the revenue needed using the contribution margin percentage approach.

e. If the company achieves the revenue determined in part (d), what is the margin of safety (1) in dollars and (2) as a percentage?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn