(CVP analysis) Jim Tracy owns Sportsday Hotel, a luxury hotel with 60-two bedroom suites for coaches and...

Question:

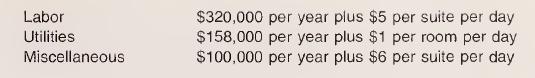

(CVP analysis) Jim Tracy owns Sportsday Hotel, a luxury hotel with 60-two bedroom suites for coaches and their players. Capacity is 10 coaches and 50 players. Each suite is equipped with extra long king-sized beds, supertail and extended shower heads, extra tall bath room vanities, a laptop, and a printer. Each suite has a Pacific Ocean view. Hotel services include airport limousine pickup and drop off, a daily fruit basket, champagne on the day of arrival, and a Hummer for transportation. Coaches and players are inter¬ viewed about their dietary restrictions and room service requirements before arrival. The hotel’s original cost was $1,920,000, and depreciation is $160,000 per year. Other hotel operating costs include:

In addition to these costs, costs are incurred for food and beverage for each guest. These costs are strictly variable and (on average) run $40 per day for coaches and $15 per day for players.

a. Assuming that the hotel is able to maintain an average annual occu¬ pancy of 80 percent in both the coach and player suites (based on a 360-day year), determine the minimum daily charge that must be as¬ sessed per suite per day to generate $240,000 of income before tax.

b. Assume that the per-day price Tracy charges is $240 day for coaches and $200 for players. If the sales mix is 12 to 48 (12 coach days of oc¬ cupancy for every 48 player days of occupancy), compute the following:

1. The break-even point in total occupancy days.

2. Total occupancy days required to generate $400,000 of income be¬

fore tax 3. Total occupancy days to generate $400,000 of after-tax income. Jim’s personal tax rate is 35 percent.

C. Tracy is considering adding a massage service for guests to complement current hotel services. He has estimated that the costs of providing such a service would largely be fixed because all necessary facilities already exist. He would, however, need to hire five certified masseurs at a cost of $500,000 per year. If Tracy decides to add this service, how much would he need to increase his daily charges (assume equal dollar in¬ creases to coach and player room fees) to maintain the break-even point computed in part (b)?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn