(CVP analysis; advanced) Piratrac Railways is a luxury passenger carrier in South Africa. All seats are first...

Question:

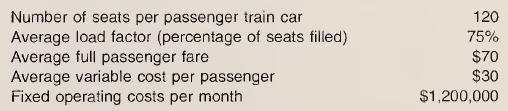

(CVP analysis; advanced) Piratrac Railways is a luxury passenger carrier in South Africa. All seats are first class, and the following data are available.

a. What is the break-even point in passengers and revenues?

b. What is the break-even point in number of passenger train cars?

c. If Piratrac raises its average passenger fare to $85, it is estimated that the load factor will decrease to 60 percent. What will be the break-even point in number of passenger cars?

d. (Refer to original data.) Fuel cost is a significant variable cost to any railway. If fuel charges increase by $8 per barrel, it is estimated that variable cost per passenger will rise to $40. What would be the new break-even point in passengers and in number of passenger train cars?

e. Piratrac has experienced an increase in variable cost per passenger to $35 and an increase in total fixed costs to $1,500,000. The company has decided to raise the average fare to $80. If the tax rate is 40 percent, how many passengers are needed to generate an after-tax profit of $400,000?

f. (Use original data.) Piratrac is considering offering a discounted fare of $50, which the company believes would increase the load factor to 80 percent. Only the additional seats would be sold at the discounted fare. Additional monthly advertising costs would be $80,000. How much pre¬ tax income would the discounted fare provide Piratrac if the company has 40 passenger train cars per day, 30 days per month?

g. Piratrac has an opportunity to obtain a new route that would be trav¬ eled 15 times per month. The company believes it can sell seats at $75 on the route, but the load factor would be only 60 percent. Fixed costs would increase by $100,000 per month for additional crew, additional passenger train cars, maintenance, and so on. Variable cost per passen¬ ger would remain at $30.

1. Should the company obtain the route?

2. How many passenger train cars would Piratrac need to earn pre-tax income of $50,500 per month on this route?

3. If the load factor could be increased to 75 percent, how many pas¬ senger train cars would be needed to earn pre-tax income of $50,500 per month on this route?

4. What qualitative factors should be considered by Piratrac in making its decision about acquiring this route?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn