(Comprehensive) New York Fashions produces and sells cotton vests. The firm uses variable costing for internal management...

Question:

(Comprehensive) New York Fashions produces and sells cotton vests. The firm uses variable costing for internal management purposes and absorption costing for ex¬ ternal purposes. At the end of each year, financial information must be converted from variable costing to absorption costing to satisfy external requirements.

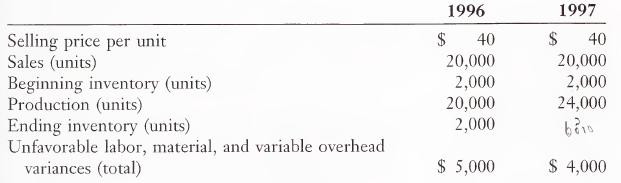

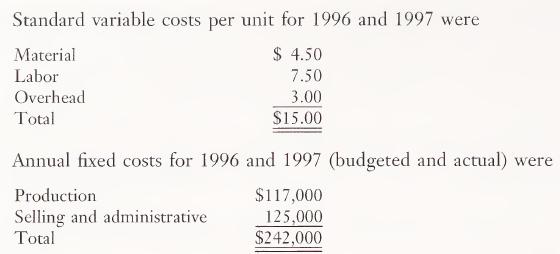

At the end of 1996, it was anticipated that sales would rise 20 percent from 1996 levels for 1997. Therefore, production was increased from 20,000 to 24,000 units to meet this expected demand. However, economic conditions kept the sales level at 20,000 for both years. The following data pertain to 1996 and 1997:

The overhead rate under absorption costing is based on practical capacity of 30,000 units per year. All variances and under- or overapplied overhead are taken to Cost of Goods Sold. All taxes are to be ignored.

a. Present the income statement based on variable costing for 1997.

b. Present the income statement based on absorption costing for 1997.

c. Explain the difference, if any, in the income figures. Assuming no Work in Process Inventory, give the entry necessary to adjust the book figure to the financial statement figure, if one is necessary.

d. The company finds it worthwhile to develop its internal financial data on a variable cost basis. What advantages and disadvantages are attributed to var¬ iable costing for internal purposes?

e. Many accountants believe that variable costing is appropriate for external reporting and many oppose its use for external reporting. What arguments for and against the use of variable costing can you think of for its use in external reporting?

(CUM adapted)LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney