(Comprehensive) Ryan Ltd.s 1998 annual budget for its three service departments (Administration, Accounting, and Engineering) and its...

Question:

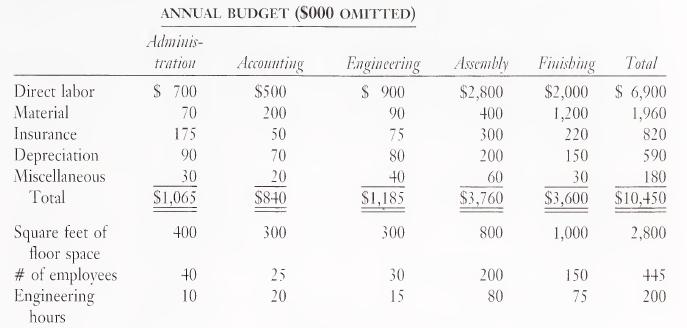

(Comprehensive) Ryan Ltd.’s 1998 annual budget for its three service departments (Administration, Accounting, and Engineering) and its two production depart¬ ments (Assembly and Finishing) is presented below.

Assume that expected 1998 activity bases in Assembly and Finishing, respectively, are 24,000 and 20,000 machine hours. /

a. Calculate the overhead allocation rate per machine hour in each revenue- producing department using the direct method.

b. Allocate service department costs to the producing departments using the step method. The service departments are listed in the benefits-provided ranking. Allocation bases for each service department’s costs are (1) Admin¬ istration, number of employees; (2) Accounting, floor space; and (3) Engi¬ neering, engineering hours. Calculate the overhead allocation rate per machine hour in each revenue-producing department.

c. Calculate the overhead allocation rate per machine hour in each revenue- producing department using the algebraic method.LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney