CVP) Abraham Inc., in business since 1995, makes swimwear for profes sional athletes. Analysis of the firms

Question:

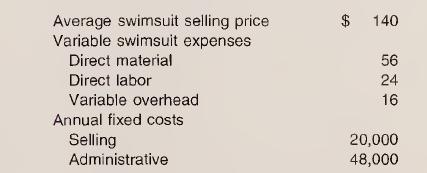

CVP) Abraham Inc., in business since 1995, makes swimwear for profes¬ sional athletes. Analysis of the firm’s financial records for the current year reveals the following:

The company’s tax rate is 40 percent. Louise Abraham, company president, has asked you to help her answer the following questions.

a. What is the break-even point in number of swimsuits and in dollars?

b. How much revenue must be generated to produce $80,000 of pre-tax earnings? How many swimsuits would this level of revenue represent?

c. How much revenue must be generated to produce $80,000 of after-tax earnings? How many swimsuits would this represent?

d. What amount of revenue would be necessary to yield an after-tax profit equal to 20 percent of revenue?

e. Abraham is considering purchasing a new faster sewing machine, which will save $12 per swimsuit in cost but will raise annual fixed costs by $8,000. She expects to make and sell an additional 5,000 swimsuits. Should she make this investment?

f. A marketing consultant told Abraham that she could increase the num¬ ber of swimsuits sold by 30 percent if she would lower the selling price by 10 percent and spend $20,000 on advertising. She has been selling 3,000 swimsuits. Should she make these two related changes?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn