Dublin Chips is a manufacturer of prototype chips based in Dublin, Ireland. Next year, in 2021, Dublin

Question:

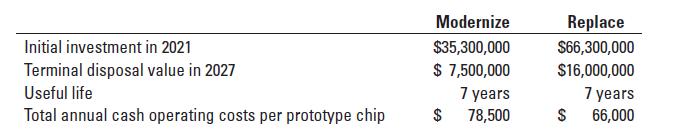

Dublin Chips is a manufacturer of prototype chips based in Dublin, Ireland. Next year, in 2021, Dublin Chips expects to deliver 615 prototype chips at an average price of $95,000. Dublin Chips’ marketing vice president forecasts growth of 65 prototype chips per year through 2027. That is, demand will be 615 in 2021, 680 in 2022, 745 in 2023, and so on. The plant cannot produce more than 585 prototype chips annually. To meet future demand, Dublin Chips must either modernize the plant or replace it. The old equipment is fully depreciated and can be sold for $4,200,000 if the plant is replaced. If the plant is modernized, the costs to modernize it are to be capitalized and depreciated over the useful life of the modernized plant. The old equipment is retained as part of the “modernize” alternative. The following data on the two options are available:

Dublin Chips uses straight-line depreciation, assuming zero terminal disposal value. For simplicity, we assume no change in prices or costs in future years. The investment will be made at the beginning of 2021, and all transactions thereafter occur on the last day of the year. Dublin Chips’ required rate of return is 14%. There is no difference between the “modernize” and “replace” alternatives in terms of required working capital. Dublin Chips has a special waiver on income taxes until 2027.

Required:

1. Sketch the cash inflows and outflows of the “modernize” and “replace” alternatives over the 2021–2027 period.

2. Calculate the payback period for the “modernize” and “replace” alternatives.

3. Calculate the net present value of the “modernize” and “replace” alternatives.

4. What factors should Dublin Chips consider in choosing between the alternatives?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292363073

17th Global Edition

Authors: Srikant Datar, Madhav Rajan