Refer to Exercise 21-27. Jose, the unit manager of Raymore, is concerned that switching to the backflush

Question:

Refer to Exercise 21-27. Jose, the unit manager of Raymore, is concerned that switching to the backflush costing system will lower the operating income of his unit. The senior management at Outdoor UnPlugged tells Jose that this will only be the case if the standard costs continue to be imprecise estimates of actual costs and that income will remain the same under the proposed backflush costing system if his team can better estimate standard costs.

Data from Exercise 21-27:

Raymore, a unit of Outdoor UnPlugged, manufactures a line of electric, cordless, lawn mowers. Senior management of Outdoor UnPlugged has noticed that Raymore has been producing more lawn mowers than it has been selling, and that the unit’s inventory has been steadily increasing. Senior management of Outdoor UnPlugged suspects that the bonus plan in place for the head of Raymore is behind this practice. Senior management of Outdoor UnPlugged is contemplating to switch from the current sequential tracking to a backflush costing system in order to stop the overproduction at Raymore. Specifically, senior management of Outdoor UnPlugged is considering a backflush costing system with the following two trigger points:

■ Purchase of direct materials

■ Sale of finished goods

Each mower takes 2 hours to assemble. There are no beginning inventories of materials or finished goods and no beginning or ending work-in-process inventories. The following data are for Raymore for March 2020:

Raymore records direct materials purchased and conversion costs incurred at actual costs. It has no direct materials variances. When finished goods are sold, the backflush costing system “pulls through” standard direct materials cost ($90 per unit) and standard conversion cost ($52 per unit). Raymore produced 17,000finished units in March 2020 and sold 16,800 units. The actual direct materials cost per unit in March 2020 was $90, and the actual conversion cost per unit was $53. Any under- or overallocated conversion costs are written off monthly to Cost of Goods Sold.

Required:

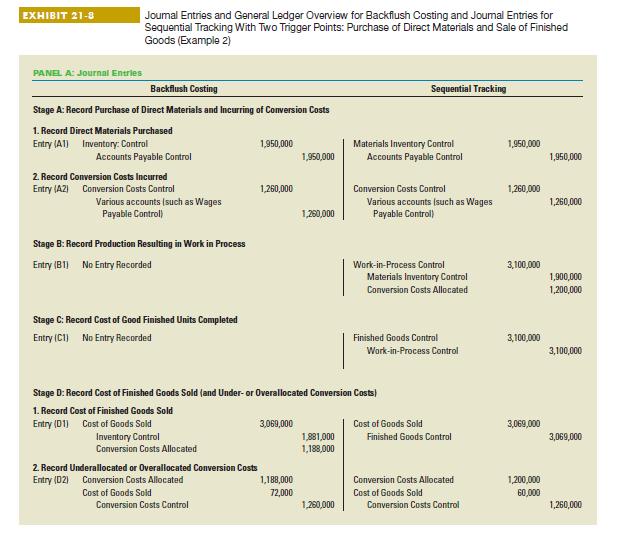

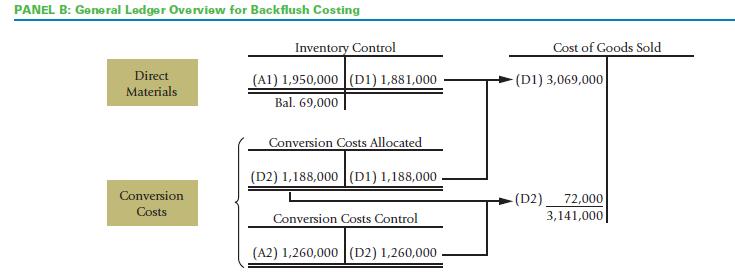

1. Assume that Jose correctly estimates the standard conversion costs to be $53 and that conversion costs incurred and conversion costs allocated are both equal to $901,000; otherwise assume the same facts as in 21-27. Following Exhibit 21-8 prepare summary journal entries for March 2020 and post the entries to applicable T-accounts for both methods the current sequential tracking and the backflush costing that senior management of Outdoor UnPlugged is considering.

Data from Exhibit 21-8:

2. Is the claim of the senior management at Outdoor UnPlugged correct that Raymore’s operating income will remain the same under the proposed backflush costing system as long as the standard costs are estimated correctly?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292363073

17th Global Edition

Authors: Srikant Datar, Madhav Rajan