(Ending inventory valuation; joint cost allocation) Emerson Meat Packers experi enced the operating statistics in the following...

Question:

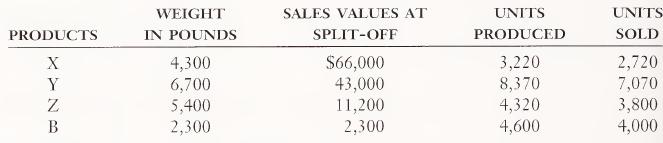

(Ending inventory valuation; joint cost allocation) Emerson Meat Packers experi¬ enced the operating statistics in the following table for its joint meat cutting process during March 1997, its first month of operations. The costs of the joint process were direct material, $24,400; direct labor, $8,200; and overhead, $4,100. Products X, Y, and Z are main products; B is a by-product. The company’s policy is to recognize the net realizable value of any by-product inventory at split-off and reduce the total joint cost by that amount. Neither the main prod¬ ucts nor the by-product require any additional processing or disposal costs, although management may consider additional processing.

a. Calculate the ending inventory values of each joint product based on (1) relative sales value and (2) pounds.

b. Discuss the advantages and disadvantages of each allocation base for (1) fi¬ nancial statement purposes and (2) decisions about the desirability of pro¬ cessing the joint products beyond the split-off point.LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney