Jeff McMillan owns a small neighborhood shopping mall. Of the 10 store spaces in the building, seven

Question:

Jeff McMillan owns a small neighborhood shopping mall. Of the 10 store spaces in the building, seven are rented by boutique owners and three are vacant. Jeff has decided that offering more services to stores in the mall would enable him to increase occupancy. He has decided to use one of the vacant spaces to provide, at cost, a gift-wrapping service to shops in the mall. The boutiques are enthusiastic about the new service. Most of them are staffed minimally, which means that every time they have to wrap a gift, phones go unanswered and other customers in line grow impatient. Jeff figured that the giftwrapping service would incur the following costs: The store space would normally rent for $1,800 per month; part-time gift wrappers could be hired for $1,500 per month;

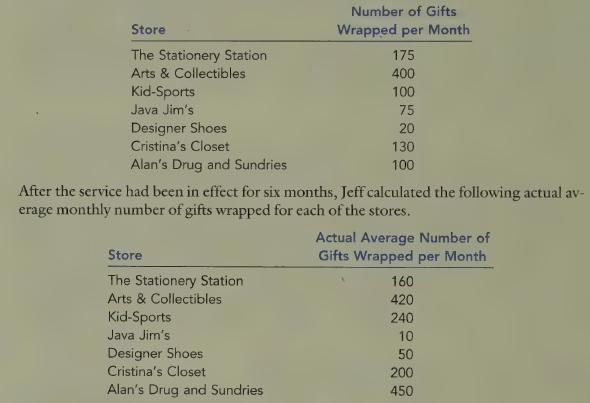

and wrapping paper and ribbon would average $1.20 per gift. The boutique owners estimated the following number of gifts to be wrapped per month.

Required:

1. Calculate a single charging rate, on a per-gift basis, to be charged to the shops. Based on the shops’ actual number of gifts wrapped, how much would be charged to each shop using the single charging rate?

2. Based on the shops’ actual number of gifts wrapped, how much would be charged to each shop using the dual charging rate?

3. Which shops would prefer the single charging rate? Why? Which would prefer the dual charging rate, and why?

4. Several of the shop owners were angry about their bill for the gift-wrapping service.

They pointed out that they were to be charged only for the cost of the service. How could you make a case for them?LO1

Step by Step Answer:

Introduction To Cost Accounting

ISBN: 9780538749633

1st International Edition

Authors: Don R. Hansen, Maryanne Mowen, Liming Guan, Mowen/Hansen