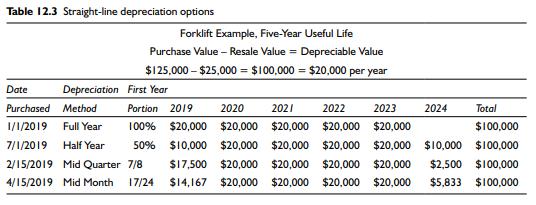

Looking back to our Table 12.3 forklift depreciation example, assuming a 2019 purchase date, what is the

Question:

Looking back to our Table 12.3 forklift depreciation example, assuming a 2019 purchase date, what is the book value of the equipment at the end of the third full year of ownership for each of the options presented?

Transcribed Image Text:

Table 12.3 Straight-line depreciation options Forklift Example, Five-Year Useful Life Purchase Value - Resale Value = Depreciable Value $125,000-$25,000 $100,000 $20,000 per year Depreciation First Year Date Purchased Method 1/1/2019 Full Year 7/1/2019 Half Year 2/15/2019 Mid Quarter 7/8 4/15/2019 Mid Month 17/24 2022 2023 Total 2020 2021 $20,000 $20,000 $20,000 $20,000 $100,000 $100,000 $10,000 $20,000 $20,000 $20,000 $20,000 $10,000 $17,500 $20,000 $20,000 $20,000 $20,000 $2,500 $100,000 $14,167 $20,000 $20,000 $20,000 $20,000 $5,833 $100,000 Portion 2019 100% $20,000 50% 2024

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Full 125000 65000 ...View the full answer

Answered By

Wahome Michael

I am a CPA finalist and a graduate in Bachelor of commerce. I am a full time writer with 4 years experience in academic writing (essays, Thesis, dissertation and research). I am also a full time writer which assures you of my quality, deep knowledge of your task requirement and timeliness. Assign me your task and you shall have the best.

Thanks in advance

4.90+

63+ Reviews

132+ Question Solved

Related Book For

Cost Accounting And Financial Management For Construction Project Managers

ISBN: 9781138550650

1st Edition

Authors: Len Holm

Question Posted:

Students also viewed these Business questions

-

The following information relates to Hawkrigg Corporations purchase of equipment on 15 June 20X7: Invoice price ..................... $ 210,000 Discount for early payment (if paid by 30 June)..........

-

Shyam Ltd. invited applications for issuing 80,000 shares of 10 each at a premium of 40 per share. The amount was payable as follows: On Application On Allotment *35 per share (including 30 premium)...

-

The following information relates to Riggs Corp.s purchase of equipment on 15 June 20X7: Invoice price ................................................................................ $420,000...

-

The following is the documentation of the payroll cycle at McQuarrie Enterprises, a ladies clothing wholesaler. There are approximately 50 staff members at McQuarrie Enterprises. Every employee has a...

-

The motion of the uniform rod AB of mass 8 kg and length h L = 900 mm is guided by small wheels of negligible mass that roll on the surface shown. If the rod is released from rest when =20?,...

-

Allright Test Design Company creates, produces, and sells Internet-based CPA and CMA review courses for individual use. Davis Webber, head of human resources, is convinced that question development...

-

HOW ARE ERP SYSTEMS IMPLEMENTED AND UPGRADED?

-

Charlene owns a 70% interest in Maupin Mopeds, which is organized as a partnership. She wants to open another business and needs office space for it. She has Maupin distribute a building worth...

-

Prepare the direct labor cost budget for July

-

What is the difference between book value and salvage value?

-

How do third-party equipment rental companies account for their equipment repair and maintenance?

-

A large piece of equipment acquired on 1 January 20X5 by Kapadia Company has four major components for depreciation. Details regarding each component are given in the schedule below: Required: 1....

-

Fineas Co. use the Job Order Costing system to determine product costs. Before entering 2020, the company has created a production budget, with an estimated total manufacturing overhead of $...

-

Define what a market value is? What are three major principles of investing funds? How does the federal government control the money supply? An investor purchases a 10-year U.S. Treasury note and...

-

1. Suppose we have two alternative designs, each of which yields a different present value of the total lifetime cost: the first is $1604 and the second is $1595. Verify that the present value of the...

-

Sometimes when we are asked for a linear model, the information that we are given is data about a scenario. In these cases we have to use Excel to generate a trendline. There is a video in this...

-

1. Purpose Explain 3 points from the Introduction section as to why this study is important. How did this study build on the existing literature in this area? 2. Participants Outline at least 2...

-

You are told that (X) = 8 and var (X) = 4. What are the expected values and variances of the following expressions? a. Y = 3X + 2 b. Y = 0.6X - 4 c. Y = X/4 d. Y = aX + b, where a and b are constants...

-

In your readings, there were many examples given for nurturing close family relationships in this ever-evolving technological society we live in Based upon your readings and research describe three...

-

What is the contribution margin percentage per plate of fried rice? a. 2 b. 50% c. 33.33% d. 66.67% You are given the following details regarding the operations of Cheng Hi Fried Rice Restaurant....

-

Sales volume next year is anticipated to be 50,000 plates of fried rice. By what percentage would the selling price have to be changed to generate a net income of 75,000, assume corporate tax is 25%,...

-

Daytona Wheels is a Japanese tire manufacturer. For August 2021, it budgeted to manufacture and sell 3,000 tires at a variable cost of $74 per tire and total fixed costs of $54,000. The budgeted...

-

Suppose you bought a bon with an annual coupon rate of 6.5 percent one year ago for $1,032. The bond sells for $1,020 today. a. Assuming a $1,000 face value, what was your total dollar return on this...

-

During the year 2021, William has a job as an accountant, he earns a salary of $100,000. He has done some cleaning services work on his own (self-employed), where he earned a net income of $50,000....

-

Fixed cost per unit is $7 when 25,000 units are produced and $5 when 35,000 units are produced. What is the total fixed cost when 30,000 units are produced? Group of answer choices $150,000....

Study smarter with the SolutionInn App