(Master budget preparation) Cheyenne Chemical Company manufactures a red industrial dye. The company is preparing its 1997...

Question:

(Master budget preparation) Cheyenne Chemical Company manufactures a red industrial dye. The company is preparing its 1997 master budget and has pre¬ sented you with the following information.

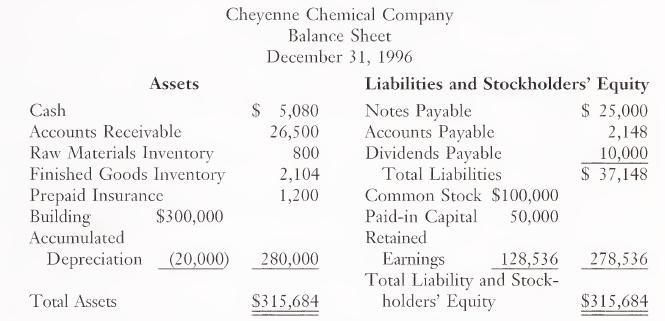

1.The December 31, 1996, balance sheet for the company is shown below.LO1 2. The Accounts Receivable balance at 12/31/96 represents the remaining bal¬ ances of November and December credit sales. Sales were $70,000 and $65,000, respectively, in those two months. 3. Estimated sales in gallons of dye for January through May 1997 are shown below.

2. The Accounts Receivable balance at 12/31/96 represents the remaining bal¬ ances of November and December credit sales. Sales were $70,000 and $65,000, respectively, in those two months. 3. Estimated sales in gallons of dye for January through May 1997 are shown below. 4. The collection pattern for accounts receivable is as follows: 70 percent in the month of sale; 20 percent in the first month after the sale; 10 percent in the second month after the sale. Cheyenne Chemical expects no bad debts and no customers are given cash discounts. 5. Each gallon of dye has the following standard quantities and costs for direct materials and direct labor:

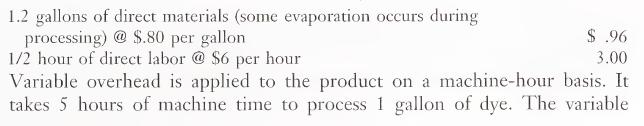

4. The collection pattern for accounts receivable is as follows: 70 percent in the month of sale; 20 percent in the first month after the sale; 10 percent in the second month after the sale. Cheyenne Chemical expects no bad debts and no customers are given cash discounts. 5. Each gallon of dye has the following standard quantities and costs for direct materials and direct labor:

overhead rate is $.06 per machine hour; VOH consists entirely of utility costs. Total annual fixed overhead is $120,000; it is applied at $1.00 per gallon based on an expected annual capacity of 120,000 gallons. Fixed over¬ head per year is composed of the following costs:

Fixed overhead is incurred evenly throughout the year. 6. There is no beginning inventory of Work in Process. All work in process is completed in the period in which it is started. Raw Materials Inventory at the beginning of the year consists of 1,000 gallons of direct materials at a standard cost of $.80 per gallon. There are 400 gallons of dye in Finished Goods Inventory at the beginning of the year carried at a standard cost of $5.26 per gallon: Direct Materials, $.96; Direct Labor, $3.00; Variable Overhead, $.30; and Fixed Overhead, $1.00. 7. Accounts Payable relates solely to raw materials. Accounts payable are paid 60 percent in the month of purchase and 40 percent in the month after purchase. No discounts are given for prompt payment. 8. The dividend will be paid in January 1997. 9. A new piece of equipment costing $9,000 will be purchased on March 1, 1997. Payment of 80 percent will be made in March and 20 percent in April. The equipment will have no salvage value and has a useful life of 3 years. 10. The note payable has a 12 percent interest rate; interest is paid at the end of each month. 11. Cheyenne Chemical’s management has set a minimum cash balance at $5,000. Investments and borrowings are made in even $100 amounts. In¬ vestments will earn 9 percent per year. 12. The ending inventory of Finished Goods Inventory should be 5 percent of the next month’s needs. This is not true at the beginning of 1997 due to a miscalculation in sales for December. The ending inventory of raw materials should be 5 percent of the next month’s needs. 13. Selling and administrative costs per month are as follows: salaries, $18,000; rent, $7,000; and utilities, $800. These costs are paid in cash as they are incurred.

Prepare a master budget for each month of the first quarter of 1997 and pro forma financial statements as of the end of the first quarter of 1997.

LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney