(Monetary measure allocation) Wallace Realty has two operating divisions: Leasing and Sales. In March 1998, the firm...

Question:

(Monetary measure allocation) Wallace Realty has two operating divisions: Leasing and Sales. In March 1998, the firm spent $100,000 for general company pro¬ motions (as opposed to advertisements promoting specific properties). Wilma Hingle, the corporate controller, is now faced with the task of fairly allocating the promotion costs to the two operating divisions.

Wilma has reduced the potential bases for allocating the promotion costs to two alternatives: the expected revenue to be generated for each division from the promotions, or the expected profit to be generated in each division from the promotion.

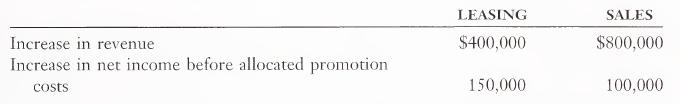

The promotions are expected to have the following effects on the two divisions:

a. Allocate the total promotion costs to the two divisions using change in revenue.

b. Allocate the total promotion costs to the two divisions using change in net income before joint cost allocation.

c. Which of the two approaches is most appropriate? Explain.LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney