Part 1 The Waltburys lived at Treefain in the Rea Valley. A closeknit, lively and enterprising family,

Question:

Part 1 The Waltburys lived at Treefain in the Rea Valley. A closeknit, lively and enterprising family, they had been in business as agricultural engineers for eighty years. The present generation consisted of the parents and three children, the daughter who looked after the business records and two sons who had studied agricultural engineering. It did look until recently that such a small business would not be able to support all the children, but now the future looked very different.

It all began so simply and in a small way. Robert, the youngest, inherited the Volkswagen Beetle. It had been ‘handed down’ through the children, and had been the means whereby they all had learnt their car mechanics. The idea was born to put a new body on the old floorpan (chassis), and they experimented with various forms of bodywork: alloy panels secured to a frame with rivets, fibre glass (G.R-P.) moulded to an old Packard sports car shape. Mark I was amusing, Mark II primitive, Mark III unusual, Mark IV... well, remarkably good, resembling a 1930's sports car, distinctive and attractive. The ‘Waltbury’ soon became well known in the area, and when featured in the Northbridge Journal, the local newspaper, enquiries rolled in and a steady flow of orders ensued. It immediately became apparent that there were many types of customer, those who wanted a complete car perhaps modified to their taste, and then enthusiasts who wished to build their own car from a kit. These latter enthusiasts often already had a chassis and engine, but there were some who looked to the business to supply this running gear as well. Others required a car to the point of application of the first coat of primer paint... There was a demand for cars at all stages of completion and for all types of popular running gear modification.

There were inevitably many technical problems in the early days to which the family involved themselves with enthusiasm, often working well into the night. Just as inevitably there were financial, administrative and clerical problems which the male Waltbury’s avoided unless forced to by some crisis. The ‘admin’ side was Susan’s ran the argument, and usually........

Questions:-

1. a. Why is job costing appropriate to the manufacture of Alternative Cars.

b. Why would process costing not be suitable.

c. Which basic records and forms must be completed to ensure a sound job costing system.

d. Name 3 other manufacturing situations that might use job costing.

e. Contrast job costing with batch costing.

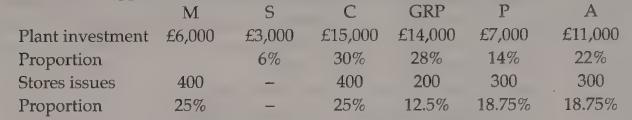

2. The following overhead is appropriate to one month for Alternative Cars:

i. Maintenance and repair of equipment (by centres) Stores £78, Chassis £309, G.R.P. £346, Panels £77, Assembly £90.

ii. Depreciation 10% of plant values.

iii. Rent £800.

iv. Indirect labour £960.

v. Labour costs £600.

vi. Indirect materials £490.

Using the information contained in Figure 1:

a. Prepare an overhead analysis sheet.

b. Calculate overhead absorption rates based on direct production hours.

c. Calculate a blanket absorption rate.

3. Assume that because of the growth in business, Alternative Cars create a separate maintenance department. The business now has two service departments, maintenance (M) and Stores (S) and four production departments Chassis (C), Mouldings (GRP), Panels (P) and Assembly (A). The service departments provide services for each other as well as for the production departments.

The overheads for a period after analysis are:

![]()

The data for apportionment of service department overheads:

Reapportion the service centre overhead to production centres on:

a. The continuous allotment method

b. The elimination (or 1 step) method.

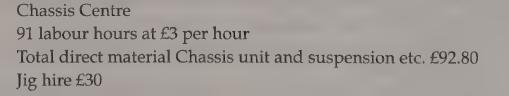

4. Job 672 was the conversion of an Alfasud Saloon to accept a Waltbury Mark V body kit. This involved stripping the Alfa and fitting a multi-tubular chassis based on box section steel members. The chassis was to be constructed with a top wishbone, front suspension and shock absorbers. In addition the propeller shaft and steering column had to be modified.

Most of the parts were standard from the normal Escort conversion, but adjustments were necessary compared with the orthodox chassis building. In particular a special precision jig tool had to be hired to ensure exact matching with the body kit.

Actual figures were:

a. Calculate the cost of Job 627. Assume that the target profit on labour intensive work is 20% of total cost. Overhead should be absorbed on the rates calculated in 2b.

b. In the light of the result if the estimate invoice price is maintained, what advice would you give to Alternative Cars both for this and future orders.

c. Recalculate the invoice price using the blanket absorption rates calculated in 2c.

d. Comment upon the two prices you have now calculated. Which approach is the more reliable and why?

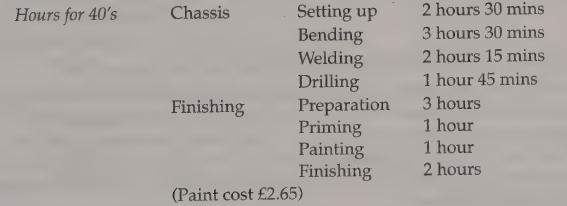

5. What is the cost per roll-over bar when produced in batches of 20 as compared with batches of 30. Assume overhead data is as calculated in 2b. and the wage rate currently being paid is £3 per hour.

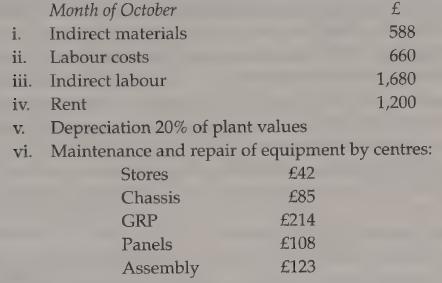

6. For the month of October the overhead below was budgeted for Alternative Cars.

Using the information contained in Figure 1 prepare an overhead analysis sheet for the month together with the cost centre absorption rates and the blanket rate.

7. Refer back to Question 3. Now reapportion the service centre overhead to production centres on the direct method (where all inter-service servicing is ignored).

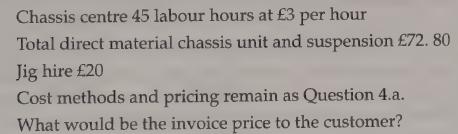

8. a. Assume that an immediate repeat order for a Job 672 is received from that customer’s brother. The actual figures for Job 672 R are as follows:

b. Do you feel this invoice price should be the one to be charged to the new customer?

9. What is the cost per roll-over bar when produced in batches of 40 as compared with batches of 20 and 30.

Assume overhead data is as calculated in 2.b. and the wage rate currently being paid is £3 per hour.

Part 2 The remarkable growth of Alternative Cars from its humble beginnings at Treefain to one of Europe’s largest kit manufacturers merits every respect and admiration. Behind the technical and creative drive of the two brothers lay a very firm and sound financial control influence.

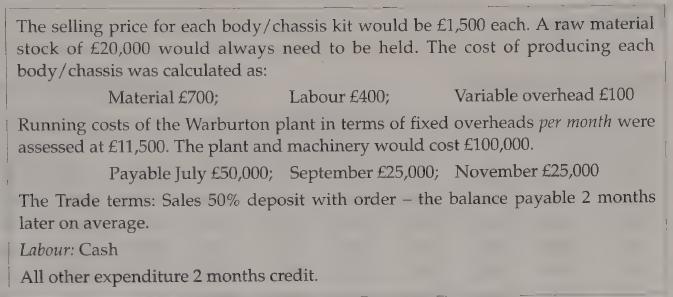

The Small Business Finance Corporation (S.B.EC.) understood from the beginning that they were backing a winner if only they could curb some of the wilder over-imaginative dreams of the technical boys who assumed that an infinite supply of money was available. In Susan they found a willing and able administrator whose rulings and judgements were accepted, not necessarily without a fight, but eventually accepted they were. The S.B.EC. could afford to control from a distance. Take for instance the new Body /Chassis Plant at Warburton.

The Waltbury Mark IV was a major design breakthrough in a number of ways. It retained the rugged sportscar style of the 30’s but was able to seat 4 people in comfort. Fixed chassis tubes were placed along the outer cockpit sides to give protection against side impact. Another feature from the kit market angle, was that the body/chassis was precision jig-drilled and designed to accept the mechanical components from estates, vans and cars of 8 of Europe's most widely sold vehicles. In nearly all of these cases no modifications would be necessary to suspension, engine, gearbox or propeller shaft. New premises, different methods of production, more sophisticated machinery, greater advertising, enthusiasm and expectation ran very high and the sky seemed the limit.

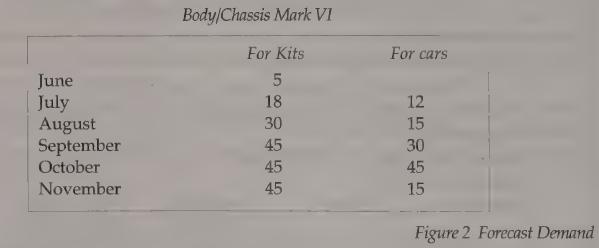

The S.B.EC. did not wish to dampen these enthusiasms but clearly there were dangers, particularly from the cash flow point of view. Through Susan they were able to instil some measure of planning, crude perhaps and little more than forecasts, but they did help. Looking back it is surprising just how accurate some of these guesses were. Take for example that first demand schedule shown in Figure 2.

A stock level of 15 to be held at the end of November.

It was the cash requirements of the venture that gave the greatest concern and Susan was grateful for the support given to her by the S.B.EC. staff. Alternative Cars was to be no longer the small happy-go lucky jobbing business of the past; money and finance were now to rule over all the major decisions. In a summary form Figure 3 shows the conclusions that were reached for those early months of the body plant venture which was to prove a watershed in the life of that family business.

Questions:-

10. Prepare a production schedule for the period June to November. This schedule must take into account that no more than 60 body/chassis can be manufactured each month.

11. Prepare a cash budget monthly June to November to indicate to the S.B.E.C. the level of funding required 12. Assuming that the plant has a life of 5 years and a resale value of £10,000, what is the normal profit per month from the body/chassis centre when maximum production is sold. (Ignore any interest charges.)

13. How many body/chassis must Alternative Cars sell each year to break even.

14. Prepare an alternative production schedule for the period June to November. This schedule must take into account that other than the first month (June) production must be in each month either 60 or 65 body/chassis to achieve efficient working.

In June it is planned to produce 10 only.

15. On the basis of this revised production schedule, prepare a new cash budget for the first 4 months of this period.

16. Assuming that the plant has a life of 10 years and a resale value of £10,000, what is the profit /loss per month when:

a. Producing and selling at 10 per month

b. Producing and selling at 65 per month 17. How many body/chassis must Alternative Cars sell each year to achieve a profit of:

a. £93,000

b. £3,000

c. £153,000

Step by Step Answer: