The Multi-Manufacturing group consists of a number of manufacturing companies. They have recently acquired a new company,

Question:

The Multi-Manufacturing group consists of a number of manufacturing companies.

They have recently acquired a new company, Total Fabrication Ltd and are considering the system of product costing to be used in the company.

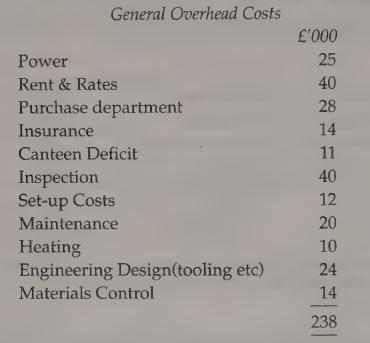

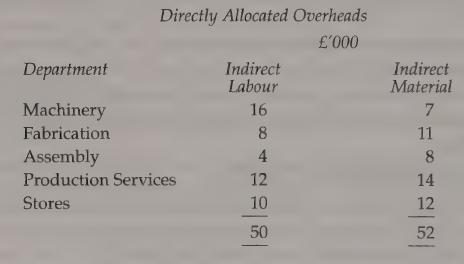

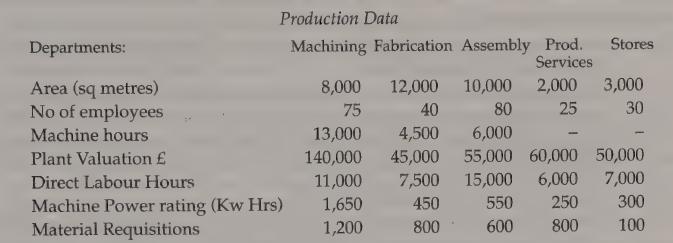

During the purchase negotiations the Group received a considerable amount of raw data which is being studied by the Group Management Accountant. A summary of the information is as follows.

Total Fabrications produces sophisticated control and weighing units for use on conveyors in quarries and mines in four main types; A, B, C and D. There are three production departments; Machining, Fabrication, Assembly (which includes calibration)

and two service departments; Production Services and Stores. The latest available financial and production data are as follows:

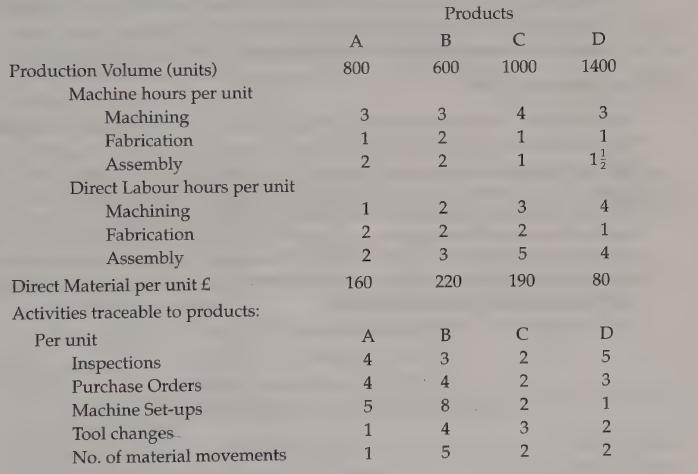

The data relating to the products are as follows:

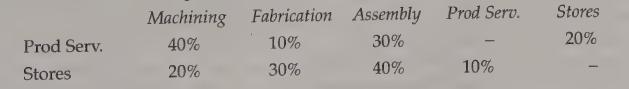

The demands on Service Departments are:

Direct wages are £7 per hour.

The Group Management Accountant decides to carry out further analysis before deciding what type of product costing system he will recommend.

Questions:-

1. Prepare an overhead analysis based on conventional absorption costing using traditional apportionment bases.

2. Calculate the product cost per unit of the four products assuming that overhead absorption is based on machine hours.

3. Prepare an overhead analysis and appropriate cost driver rates assuming ABC will be used. Make what judgements and assumptions you feel necessary 4. Calculate the product costs based on ABC.

5. Compare the product costs prepared by conventional absorption costing and those using ABC and comment on the likely reasons for any differences.

6. What other factors do you think will need to be considered before a decision is made on which product costing system will be used?

7. What further analysis will be needed if a full ABC system is to be used?

Step by Step Answer: