(Transfer prices) Green & Marshand LLC has three revenue departments: liti gation (Lit.), family practice (FP), and...

Question:

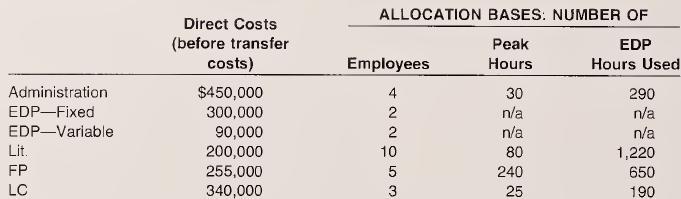

(Transfer prices) Green & Marshand LLC has three revenue departments: liti¬ gation (Lit.), family practice (FP), and legal consulting (LC). In addition, the company has two support departments, administration and EDP. Administra¬ tion costs are allocated to the three revenue departments on the basis of number of employees. EDP’s fixed costs are allocated to revenue depart¬ ments on the basis of peak hours of monthly service expected to be used by each revenue department. EDP’s variable costs are assigned to the revenue departments at a transfer price of $40 per hour of actual service. Following are the direct costs and the allocation bases associated with each of the departments:

a. Was the variable EDP transfer price of $40 adequate? Explain.

b. Allocate all service department costs to the revenue-producing depart¬ ments using the direct method.

c. What are the total costs of the revenue-producing departments after the allocation in part (b)? LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn