(Variances and variance responsibility) Childsafe Product Corporation began op erations in 1995. In 1996, the company manufactured...

Question:

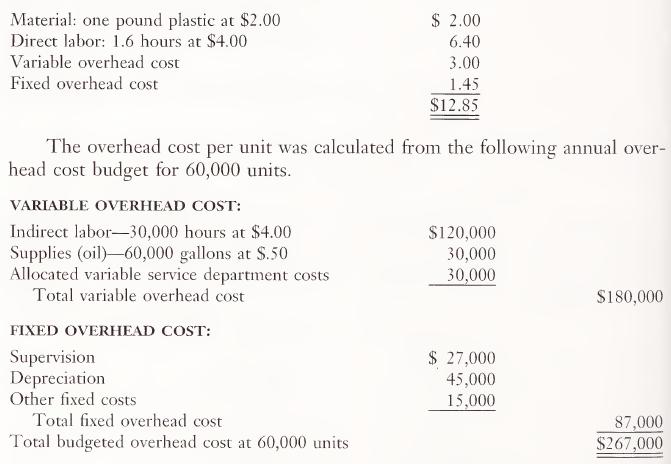

(Variances and variance responsibility) Childsafe Product Corporation began op¬ erations in 1995. In 1996, the company manufactured only one product, a hand- painted toy horse. The 1996 standard cost per unit is as follows:

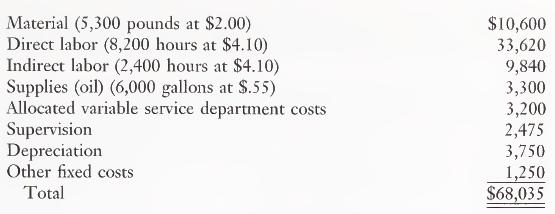

Following are the charges to the manufacturing department for November, when 5,000 units were produced:

The Purchasing Department normally buys about the same quantity as is used in production during a month. In November, 5,200 pounds of material were purchased at a price of $2.10 per pound.

a. Calculate the following variances from standard costs for the data given: 1. Materials purchase price 2. Materials quantity 3. Direct labor rate 4. Direct labor efficiency 5. Overhead budget

b. The company has divided its responsibilities so that the Purchasing Depart¬ ment is responsible for the price at which materials and supplies are pur¬ chased. The Manufacturing Department is responsible for the quantities of materials used. Does this division of responsibilities solve the conflict be¬ tween price and quantity variances? Explain your answer.

c. Prepare a report detailing the overhead budget variance. The report, which will be given to the Manufacturing Department manager, should show only that part of the variance that is her responsibility and should highlight the information in ways that would be useful to her in evaluating departmental performance and when considering corrective action.

d. Assume that the departmental manager performs the timekeeping function for this manufacturing department. From time to time analyses of overhead and direct labor variances have shown that the manager has deliberately mis- classified labor hours (i.e., listed direct labor hours as indirect labor hours and vice versa) so that only one of the two labor variances is unfavorable. It is not feasible economically to hire a separate timekeeper. What should the company do, if anything, to resolve this problem?

LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney