Accounting for joint products You have just been hired as the chief cost accountant for the J&M

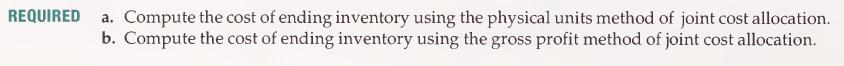

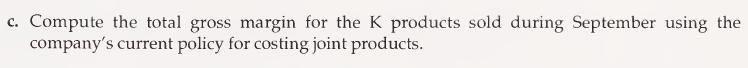

Question:

Accounting for joint products You have just been hired as the chief cost accountant for the J&M Company. Its major product group is four food processing solutions, which are pro- duced in a joint production process. The four products, Kl, K2, K3, and K4, sell for $5, $7, $10, and $15 per gallon respectively.

September production yielded 25,000 gallons of Kl, 20,000 gallons of K2, 10,000 gallons of K3, and 5,000 gallons of K4. Joint costs were direct material of $140,000, direct labor of $50,000, and manufacturing overhead of $80,000. Kl and K2 are sold at split off, but K3 and K4 required additional processing costs of $20,000 and $40,000 respectively.

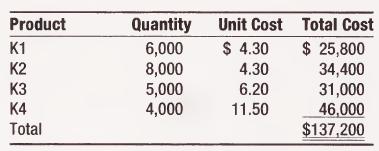

The company uses the physical units method to allocate joint cost to products, but some managers have asked why Kl and K2 have the same product cost when they sell for different prices. One accountant suggested that the gross profit method may be a better way of allocating joint product costs. At the beginning of September, the company had the following inventory quantities and cost for K products:

During September, the company sold 22,000 gallons of Kl, 16,000 gallons of K2, 13,000 gallons of K3, and 6,000 gallons of K4.

Step by Step Answer: