Alternative accounting treatment of by-products Tineley Chemicals, Inc. produces Solvoe and Solvine in a joint production process.

Question:

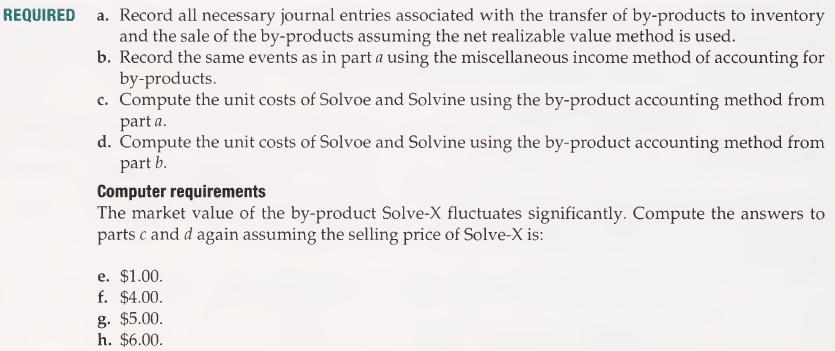

Alternative accounting treatment of by-products Tineley Chemicals, Inc. produces Solvoe and Solvine in a joint production process. In addition to these two joint products, a by-product, Solve-X, separates from the main production process shortly before the joint-product split-off point. The last batch of this product group yielded 4,000 gallons of Solvoe, 6,000 gallons of Solvine, and 3,000 pounds of Solve-X. The selling price is $6.00 per gallon for Solvoe and $9.00 per gallon for Solvine. The price of the by-product is $2.50 per pound. Joint production costs were direct materials $30,000, direct labor, $15,000, and manufacturing overhead $10,000. Solvoe is sold at split-off, and Solvine required $9,000 in additional processing costs after the split-off point. The by-product requires no additional processing costs after separating from the main products, and there is a 10 percent marketing and distribution cost for the by-product. Tineley Chemicals uses the physical units method of accounting for joint costs.

Step by Step Answer: