Analyze Alternative Products: Ocean Company manufactures and sells three different products: Ex, Why, and Zee. Projected income

Question:

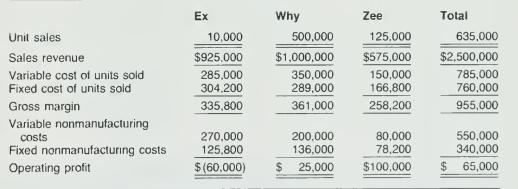

Analyze Alternative Products: Ocean Company manufactures and sells three different products: Ex, Why, and Zee. Projected income statements by product line for the year are presented below:

Production costs are similar for all three products. Fixed nonmanufacturing costs are allocated to products in proportion to revenues. The fixed cost of units sold is allocated to products by various allocation bases, such as square feet for factory rent. machine-hours for repairs, and so forth.. Ocean management is concerned about the loss on product Ex and is considering two alternative courses of corrective action. Alternative A. Ocean would purchase some new machinery for the production of product Ex. This new machinery would involve an immediate cash outlay of $650,000. Management expects that the new machinery would reduce variable production costs so that total variable costs (cost of units sold and nonmanufacturing costs) for product Ex would be 52 percent of product Ex revenues. The new machinery would increase total fixed costs allocated to product Ex to $480,000 per year. No additional fixed costs would be allocated to products Why or Zee.

Alternative B. Ocean would discontinue the manufacture of product Ex. Selling prices of products Why and Zee would remain constant. Management expects that product Zee production and revenues would increase by 50 percent. The machinery devoted to product Ex could be sold at scrap value that equals its removal costs. Removal of this machinery would reduce fixed costs allocated to product Ex by $30,000 per year. The remaining fixed costs allocated to product Ex include $155,000 of rent expense per year. The space previously used for product Ex can be rented to an outside organization for $157,500 per year.

Required: Prepare a schedule analyzing the effect of alternative A and alternative B on pro- jected total operating profit.

Step by Step Answer: