Analyze Transfer Pricing Policy: PortCo Products is a divisionalized furniture manufacturer. The divisions are autono- mous segments,

Question:

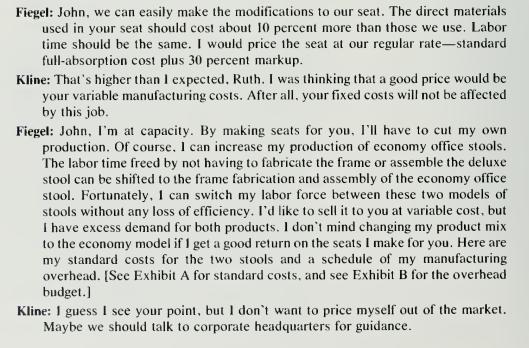

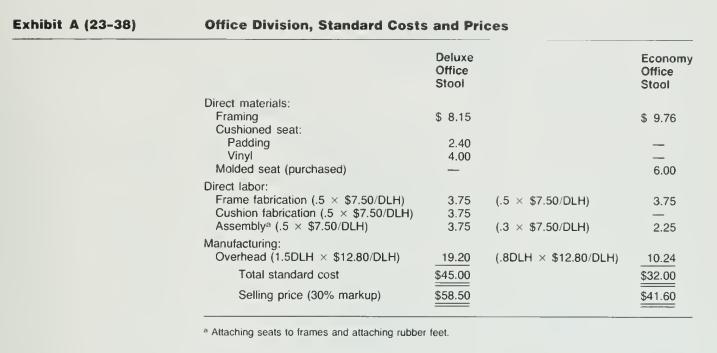

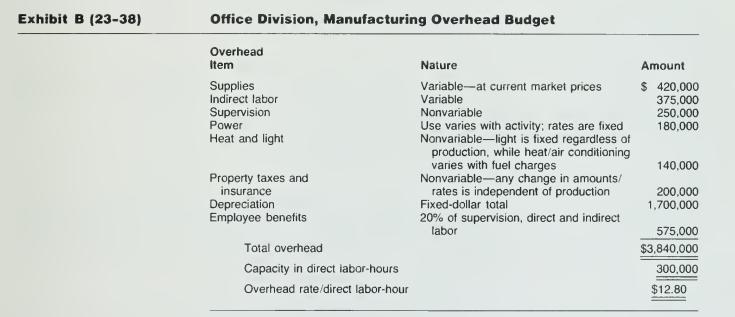

Analyze Transfer Pricing Policy: PortCo Products is a divisionalized furniture manufacturer. The divisions are autono- mous segments, with each division being responsible for its own sales. costs of operations, working capital management, and equipment acquisition. Each division serves a different market in the furniture industry. The commercial division plans to introduce a new line of counter and chair units for the restaurant industry. John Kline, the division manager, discussed the manufac- turing of the new seat with Ruth Fiegel of the office division. They both believe a similar seat currently made by the office division could be modified for use on the new counter chair. Consequently, Kline asked Ruth Fiegel for a price for 100-unit lots of the office division seats. The following conversation took place about the price to be charged for the cushioned seats.

Required: John Kline and Ruth Fiegel asked PortCo corporate management for guidance on an appropriate transfer price. Corporate management suggested they consider using a transfer price based on variable manufacturing cost plus opportunity cost. Calculate a transfer price for the cushioned seat, using variable manufacturing cost plus opportunity cost.

Step by Step Answer: