Analyzing the impact of cost allocations Thrift-Shops, Inc. operates a chain of three food stores in a

Question:

Analyzing the impact of cost allocations Thrift-Shops, Inc. operates a chain of three food stores in a state that recently enacted legislation permitting municipalities within the state to levy an income tax on corporations operating within their respective municipalities. The legislation establishes a uniform tax rate which the municipalities may levy, and regulations which provide that the tax is to be computed on income derived within the taxing municipality after a reasonable and consistent allocation of general overhead expenses. General overhead expenses have not been allocated to individual stores previously and include warehouse, general office, advertising, and delivery expenses.

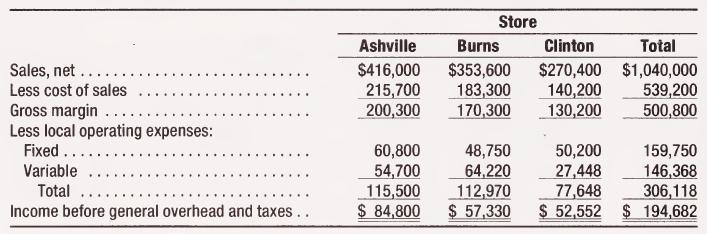

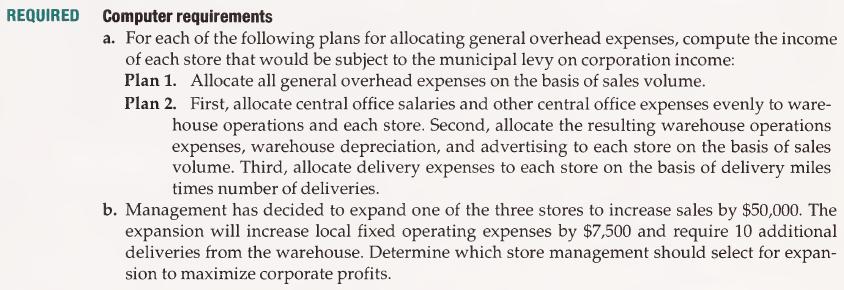

Each of the municipalities in which Thrift-Shops, Inc. operates a store has levied the corpo- rate income tax as provided by state legislation, and management is considering two plans for allocating general overhead expenses to the stores. The 1992 operating results before general overhead and taxes for each store were as follows:

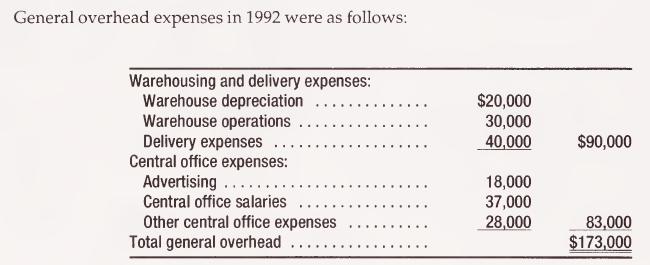

Additional information includes the following:

1. One-fifth of the warehouse space is used to house the central office and depreciation on this space is included in other central office expenses. Warehouse operating expenses vary with quantity of merchandise sold.

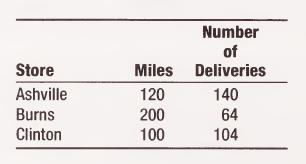

2. Delivery expenses vary with distance and number of deliveries. The distances from the warehouse to each store and the number of deliveries made in 1992 were as follows:

3. All advertising is prepared by the central office and is distributed in the areas in which stores are located.

4. As each store was opened, the fixed portion of central office salaries increased $7,000 and other central office expenses increased $2,500. Basic fixed central office salaries amount to $10,000 and basic fixed other central office expenses amount to $12,000. The remainder of central office salaries and the remainder of other central office expenses vary with sales.

Step by Step Answer: