Assess Capital Investment Project with Alternative Measures: Baxter Company manufactures toys and other short-lived products. The research

Question:

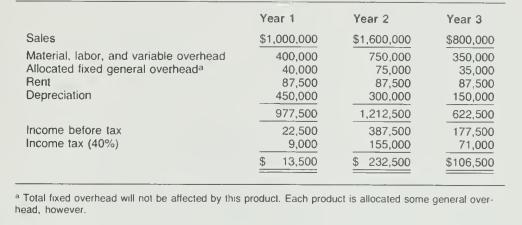

Assess Capital Investment Project with Alternative Measures: Baxter Company manufactures toys and other short-lived products. The research and development department came up with a product that would be a good promotional gift for office equipment dealers. Efforts by Baxter's sales personnel resulted in commitments for this product for the next three years. It is expected that the product's value will be exhausted by that time. To produce the quantity demanded, Baxter will need to buy additional machinery and rent additional space. About 25,000 square feet will be needed; 12,500 square feet of presently unused space is available now. Baxter's present lease with 10 years to run costs $3 a foot, including the 12,500 feet of unused space. There is another 12,500 square feet adjoining the Baxter facility which Baxter can rent for three years at $4 per square foot per year if it decides to make this product. The equipment will be purchased for about $900,000. It will require $30,000 in modifications, $60,000 for installation, and $90,000 for testing. All of these activities will be done by a firm of engineers hired by Baxter. All of the expenditures will be paid for on January I of the first year of production of the item. The equipment will have a salvage value of about $180,000 at the end of the third year.The following estimates of differential revenues and differential costs for this product for the three years have been developed:

Required:

a. Prepare a schedule to show the differential after-tax cash flows for this pro- ject. Assume equipment must be depreciated on a three-year. straight-line basis for tax purposes.

b. If the company requires a two-year payback period for its investment, would it undertake this project?

c. Calculate the after-tax accounting rate of return for the project.

d. If the company sets a required discount rate of 20 percent after taxes, will this project be accepted?

Step by Step Answer: