Capital Investment Analysis and Decentralized Performance Measurement: The following exchange occurred just after a capital investment proposal

Question:

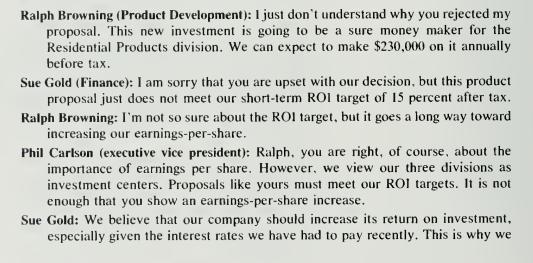

Capital Investment Analysis and Decentralized Performance Measurement: The following exchange occurred just after a capital investment proposal was re- jected at Diversified Electronics.

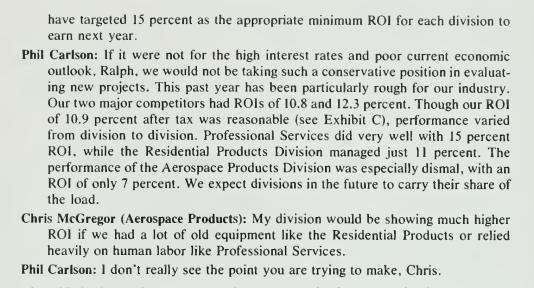

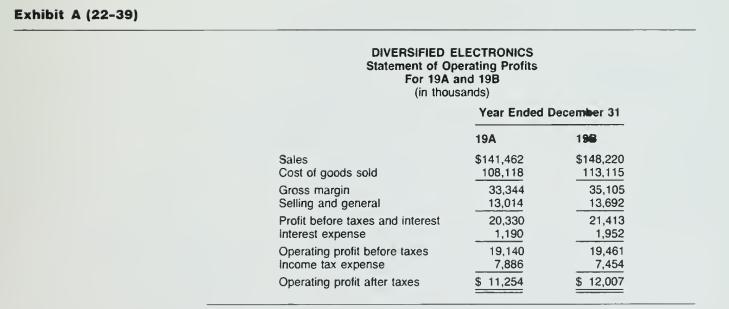

Diversified Electronics was a growing company in the electronics industry. (See Exhibits A, B, and C for financial data.) Diversified Electronics has three divisions Residential Products, Aerospace Products, and Professional Services—each of which accounts for about one third of Diversified Electronics' sales. Residential Products, the oldest division, produces furnace thermostats and similar products. The Aerospace Products Division is a large "job shop" that builds electronic devices to customer specifications. A typical job or batch takes several months to complete. About one half of Aerospace Products' sales are to the U.S. Defense Department. The newest of the three divisions, Professional Services, provides consulting en- gineering services. This division has shown tremendous growth since its acquisition by Diversified Electronics four years ago. Each division operates independently of the others and is treated essentially as a separate entity. Many of the operating decisions are made at the division level. Corporate management coordinates the activities of the various divisions, which includes review of all investment proposals over $400,000.

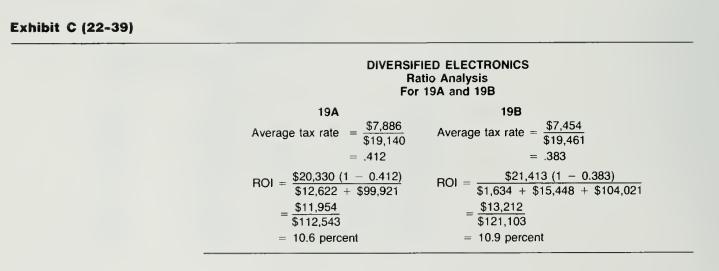

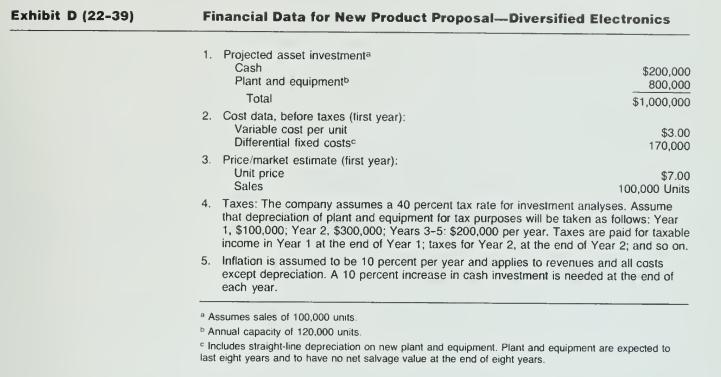

Diversified Electronic's measure of return on investment is defined as the divi- sion's operating profit before taxes and interest times one minus the income tax rate divided by investment. The investment is defined as interest-bearing debt plus owners' equity. (Calculations of ROI for the company are shown in Exhibit C.) Each division's expenses include a portion of corporate administrative expenses allocated on the basis of divisional revenues. The details of Ralph Browning's rejected product proposal are shown in Exhibit D.

Required:

a. Why did corporate headquarters reject Ralph Browning's product proposal? Was their decision the right one? Would they have rejected the proposal if they had used the net present value (NPV) method? The company uses a 15 percent cost of capital (that is, hurdle rate) in evaluating projects such as these.

b. Evaluate the manner in which Diversified Electronics implemented the invest- ment center concept. What pitfalls did they apparently not anticipate? What, if anything, should be done with regard to the investment center approach and the use of ROI as a measure of performance?

c. What conflicting incentives for managers can occur between the use of a yearly ROI performance measure and NPV for capital budgeting?

Step by Step Answer: