Comprehensive Job Costing with Equivalent Units: The Custer Manufacturing Corporation, which uses a job order cost system,

Question:

Comprehensive Job Costing with Equivalent Units: The Custer Manufacturing Corporation, which uses a job order cost system, pro- duces various plastic parts for the aircraft industry. On October 9, Year 1. production was started on Job No. 487 for 100 front bubbles (windshields) for commercial helicopters.

Production of the bubbles begins in the fabricating department where sheets of plastic (purchased as raw material) are melted down and poured into molds. The molds are then placed in a special temperature and humidity room to harden the plastic. The hardened plastic bubbles are then removed from the molds and hand- worked to remove imperfections.

After fabrication, the bubbles are transferred to the testing department where each bubble must meet rigid specifications. Bubbles that fail the tests are scrapped. and there is no salvage value.

Bubbles passing the tests are transferred to the assembly department where they are inserted into metal frames. The frames, purchased from vendors, require no work prior to installing the bubbles. The assembled unit is then transferred to the shipping department for crating and shipment. Crating material is relatively expensive, and most of the work is done by hand.

The following information concerning Job No. 487 is available as of December 31, Year 1 (the information is correct as stated):

1. Direct materials charged to the job:

a. One thousand square feet of plastic at $12.75 per square foot was charged to the fabricating department. This amount was to meet all plastic material requirements of the job assuming no spoilage.

b. Seventy-four metal frames at $408.52 each were charged to the assembly department.

c. Packing material for 40 units at $75 per unit was charged to the shipping department.

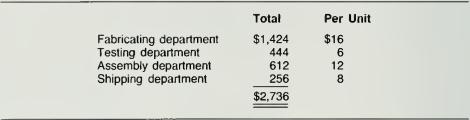

2. Direct labor charges through December 31 were as follows:

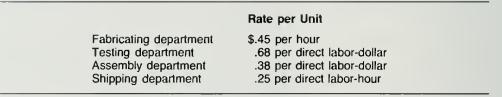

3. There were no differences between actual and applied manufacturing overhead for the year ended December 31, Year 1. Manufacturing overhead is charged to the four production departments by various allocation methods, all of which you approve. Manufacturing overhead charged to the fabricating department is allocated to jobs based on heat-room-hours; the other production departments allocate manufacturing overhead to jobs on the basis of direct labor-dollars charged to each job within the department. The following reflects the manufacturing overhead rates for the year ended December 31, Year 1.

4. Job No. 487 used 855 heat-room-hours during the year ended December 31.

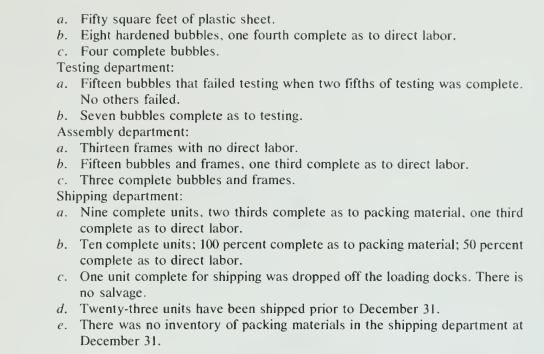

5. Following is the physical inventory for Job No. 487 as of December 31: Fabricating department:

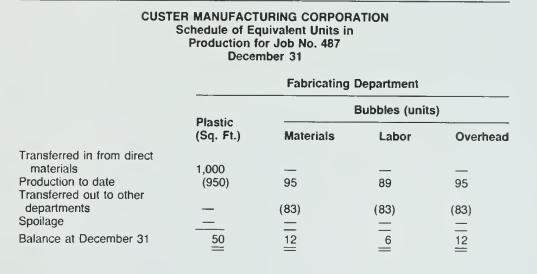

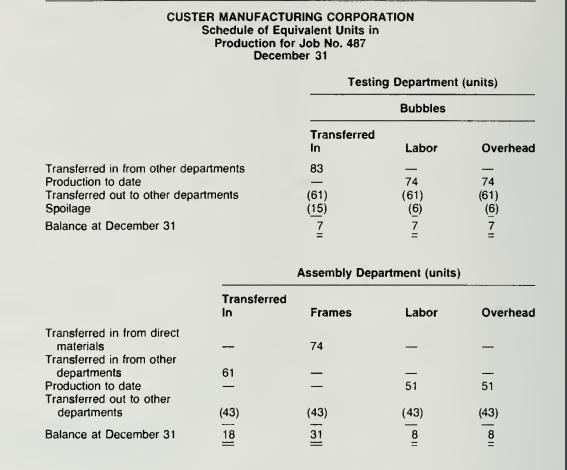

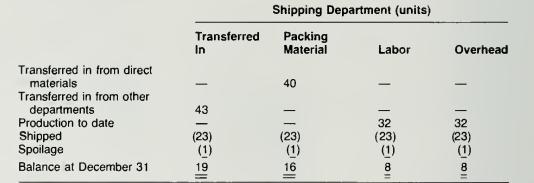

6. Following is a schedule of equivalent units in production by department for Job No. 487 as of December 31.

Required: Prepare a schedule for Job No. 487 of ending inventory costs for

(a) direct materials by department,

(b) work in process by department, and

(c) cost of goods shipped. All spoilage costs are charged to cost of goods shipped.

Step by Step Answer: