Comprehensive Review of Variances and Standard Cost Flows with Proration: Longhorn Manufacturing Corporation produces only one product,

Question:

Comprehensive Review of Variances and Standard Cost Flows with Proration: Longhorn Manufacturing Corporation produces only one product, Bevo, and ac- counts for the production of Bevo using a traditional standard cost system. At the end of each year, Longhorn prorates all variances among the various inventories and cost of sales. Because Longhorn prices its inventories on the FIFO basis and all the beginning inventories are used during the year, the variances that had been allocated to the ending inventories are immediately charged to cost of sales at the beginning of the following year. This allows only the current year's variances to be recorded in the variance accounts in any given year. Following are the standards for the production of one unit of Bevo: 3 units of item A at $1 per unit, 1 unit of item B at $.50 per unit, 4 units of item C at $.30 per unit, and 20 minutes of direct labor at $4.50 per hour. Separate variance accounts are maintained for each type of direct material and for direct labor. Direct materials are recorded at standard prices when purchased. Manufacturing overhead is applied at $9 per actual direct labor-hour and is not related to the standard cost system. There was no overapplied or underapplied manufacturing overhead at December 31, Year I. After proration of the variances, the various inventories at December 31, Year 1, were costed as follows:

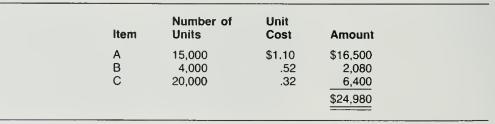

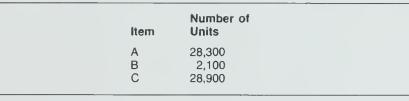

Direct materials:

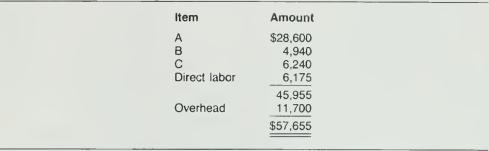

Work in process:

Nine thousand units of Bevo were 100 percent complete as to items A and B. 50 percent complete as to item C, and 30 percent complete as to labor. The composition and cost of the inventory follows:

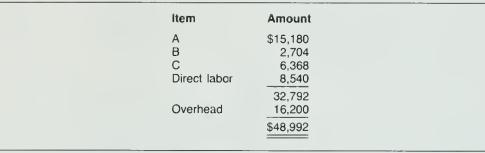

Finished goods:

Forty-eight hundred units of Bevo were costed as follows:

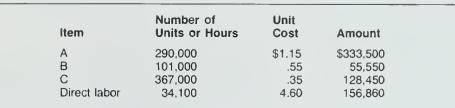

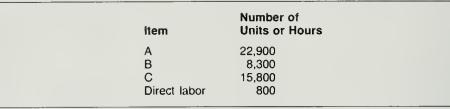

Following is a schedule of direct materials purchased and direct labor incurred for the year ended December 31, Year 2. Unit cost of each item of direct material and direct labor cost per hour remained constant throughout the year.

Purchases:

During the year ended December 31. Year 2. Longhorn sold 90.000 units of Bevo and had ending physical inventories as follows:

Direct materials:

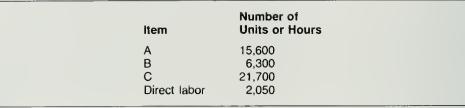

Work in process:

Seventy-five hundred units of Bevo were 100 percent complete as to items A and B, 50 percent complete as to item C, and 20 percent complete as to labor, as follows

Finished goods:

Fifty-one hundred units of Bevo, as follows:

There was no overapplied or underapplied manufacturing overhead at December 31, Year 2.

Required:

a. Prepare a schedule showing all materials and direct labor variances arising from activity in Year 2.

b. Use T-accounts to show the flow of materials and direct labor costs under the standard costing system in use.

Step by Step Answer: