Computing a total overhead variance, a budget variance, and a volume variance. The Grossinger Manufacturing Company uses

Question:

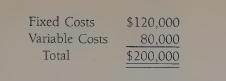

Computing a total overhead variance, a budget variance, and a volume variance. The Grossinger Manufacturing Company uses a standard cost system. The manufacturing overhead standard rate of $2.50 per unit is based on a normal yearly volume of 80,000 units, requiring 40,000 direct labor hours, and on normal budgeted costs at that volume as shown.

During the month of April 19X1, the company produced 6,800 units of its product, requiring 3,290 direct labor hours. Actual manufacturing overhead costs for the month included fixed costs of $10,000 and variable costs of $6,720.

Instructions 1. Compute the total variance between the actual and standard overhead costs for the month of April. Show whether the variances are favorable (F) or unfavorable (U).

2. Divide the variance into its component parts—a budget variance and a volume variance.

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock