Computing the cost of a by-product by the reversal cost method; preparing a cost of production report.

Question:

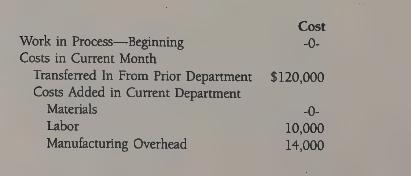

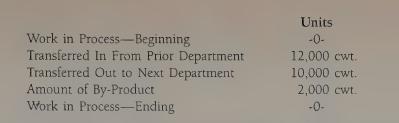

Computing the cost of a by-product by the reversal cost method; preparing a cost of production report. Departmental production data is given for the Melting Department of the Hartford Products Company for the month of April 19X3.

In the Melting Department, a by-product is recovered that reduces the quantity of the main product transferred out. This by-product is transferred to another department, where it is further processed into a chemical called Lenzoid. For each hundred pound unit (cwt.) of the by-product recovered from the main product, .5 cwt. of additional material costing $2 per cwt. must be added. Each hundredweight of Lenzoid requires additional labor of $.12 and manufacturing overhead of $.18.

(Note that for each hundredweight of the by-product recovered, 1.5 cwt. of Lenzoid will be produced.) Lenzoid has a sales value of $2.70 per hundredweight. The normal net profit margin of the company is 6 percent on sales. Estimated selling and administrative expenses are $.14 per hundredweight of Lenzoid.

Instructions 1. Compute the cost to be assigned to the 2,000 cwt. of by-product before separation, using the reversal cost method.

2. Prepare a cost of production report for the Melting Department for the month of April 19X3, based on the above data.

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock