Conversion of Variable to Full-Absorption Costing: The S. T. Shire Company uses variable costing for internal management

Question:

Conversion of Variable to Full-Absorption Costing: The S. T. Shire Company uses variable costing for internal management purposes and full-absorption costing for external reporting purposes. Thus, at the end of each year, financial information must be converted from variable costing to full-absorption costing for external reports.

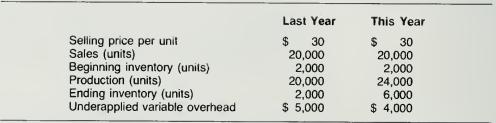

At the end of last year, management anticipated that sales would rise 20 percent this year. Therefore, production was increased from 20,000 units to 24.000 units. However, economic conditons kept sales volume at 20,000 units for both years.

The following data pertain to the two years.

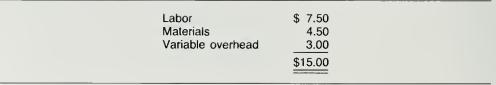

Variable cost per unit for both years was composed of:

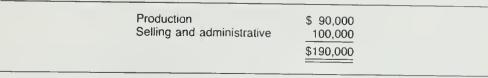

Budgeted and actual fixed costs for each year were:

The overhead rate under full-absorption costing is based on estimated volume of 30.000 units per year. Under- or overapplied overhead is taken to cost of goods sold.

Required: Using these data:

a. Present the income statement based on variable costing for this year.

b. Present the income statement based on full-absorption costing for this year.

c. Explain the difference, if any, in the operating profit figures.

Step by Step Answer: