Cost Data for Managerial Purposes : Amos Division is a division of a large corporation. It normally

Question:

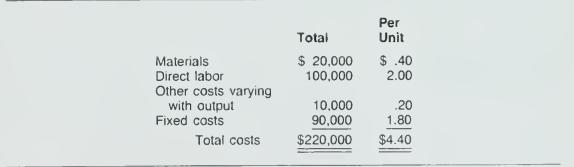

Cost Data for Managerial Purposes : Amos Division is a division of a large corporation. It normally sells to outside customers but, on occasion. will sell to another division of the corporation. When it does, corporate policy states that the price will be cost plus 10 percent. Amos received an order from the Field Division, which is also a division of the corporation, for 10,000 units. Amos Division's planned output for the year had been 50,000 units. The costs for producing those 50.000 units are:

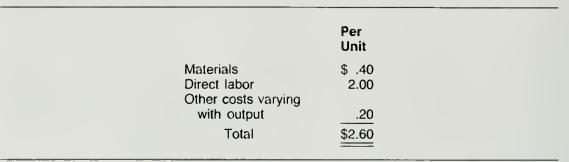

Based on these data, the Amos Division controller, who was new to the corporation, calculated that the unit price for the Field Division order should be $4.84 ($4.40 x 1 10 percent). After producing and shipping the 10,000 units, Amos Division sent an invoice for $48,400. Shortly thereafter, Amos received a note from the buyer at Field Division that stated this invoice was not in accordance with company policy. The unit cost should have been:

The price would be $2.86 ($2.60 x 1 10 percent) per unit.

Required:

If the corporation asked you to review this intercompany policy, what policy would you recommend? Why? (Note: You need not limit yourself to the Field Division calculation or current policy.)

Step by Step Answer: