Cost Data for Managerial Purposes: Lamar Corporation entered into an agreement to sell 20.000 units of a

Question:

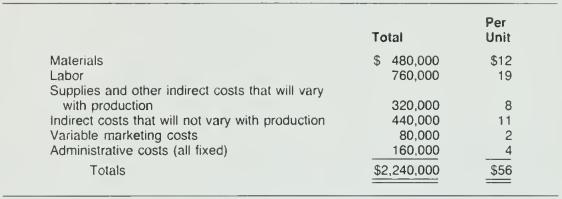

Cost Data for Managerial Purposes: Lamar Corporation entered into an agreement to sell 20.000 units of a product to a government agency this year at "cost plus 20 percent." Lamar operates a manufacturing plant that can produce 60.000 units per year. The company normally produces 40,000 units per year. The costs to produce 40.000 units are as follows:

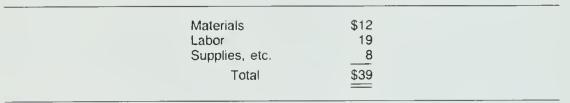

Based on the above data, company management expects to receive cash equal to $67.20 (that is. $56 120 percent) per unit for the units sold on this contract. After completing 5,000 units. the company sent a bill (invoice) to the government for $336.000 (that is, 5,000 units at $67.20 per unit). The president of the company received a call from the contracting agent for the government. The agent stated that the per unit cost should be:

Therefore, the price per unit should be $46.80 (that is. $39 * 120 percent). The agent ignored marketing costs because the contract bypassed the usual selling channels.

Required:

What price would you recommend? Why? (Note: You need not limit yourself to thei costs selected by the company or by the government agent.)

Step by Step Answer: