your client believes the share price of IBM Ltd., currently selling at $45 a share, could move substantially in either direction due to an

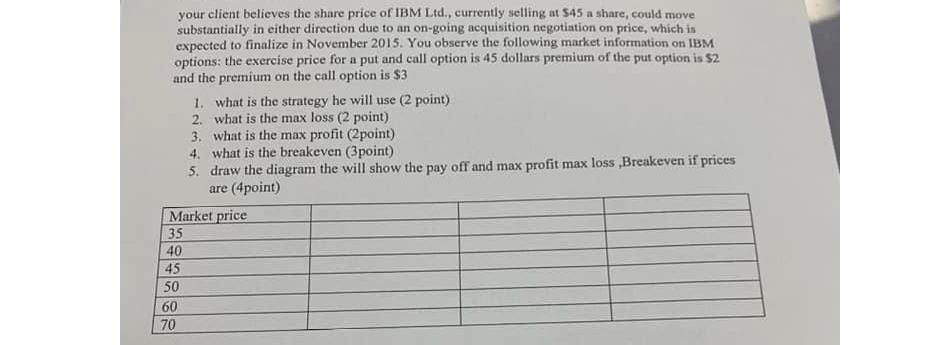

your client believes the share price of IBM Ltd., currently selling at $45 a share, could move substantially in either direction due to an on-going acquisition negotiation on price, which is expected to finalize in November 2015. You observe the following market information on IBM options: the exercise price for a put and call option is 45 dollars premium of the put option is $2 and the premium on the call option is $3 50 1. what is the strategy he will use (2 point) 2. what is the max loss (2 point) 3. what is the max profit (2point) 4. what is the breakeven (3point) Market price 35 40 45 60 70 5. draw the diagram the will show the pay off and max profit max loss ,Breakeven if prices are (4point)

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Strategy client will use Buy a put and buy a call This is called a straddle strategy ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started