CVP analysis with income tax Lucille Corporation sells a coffee maker for $40. The variable cost is

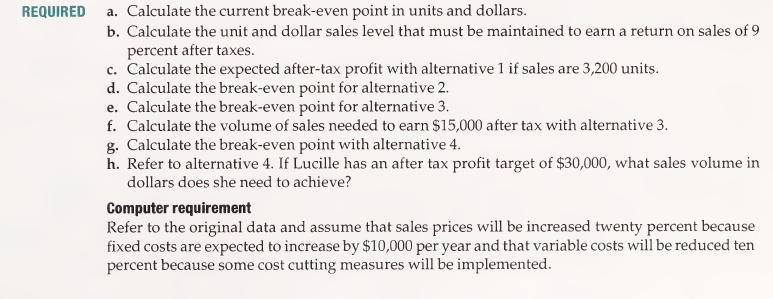

Question:

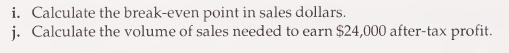

CVP analysis with income tax Lucille Corporation sells a coffee maker for $40. The variable cost is $24 per unit and fixed cost is $32,000 per year. The company is subject to a 40 percent income tax rate. Management is evaluating operations and considers making the following changes:

1. Lease a new packaging machine for $4,000 per year, reducing variable cost by $1 per unit.

2. Increase selling price 10 percent to counteract an expected 25 percent increase in fixed cost.

3. Reduce fixed cost by 25 percent by moving to a lower rent location. This would have the effect of increasing variable costs by 10 percent.

4. Advertise in local media which would cost $5,000 per year. Lucille estimates that she will be able to maintain the same variable cost per unit but increase the price per unit by 25%.

Step by Step Answer: