Eastern Refineries, Ltd. (Cost Allocations in Contract Dispute): In 1980, American Oil Corporation and United Petroleum (two

Question:

Eastern Refineries, Ltd. (Cost Allocations in Contract Dispute): In 1980, American Oil Corporation and United Petroleum (two large, integrated petroleum companies) entered into an agreement to construct and operate a pe- troleum fuels refinery in the Far East. A corporation named Eastern Refineries Limited was formed to operate the refinery. At the time the agreement was drawn up. American provided 70 percent of the capital, while United provided 30 percent. The sponsoring companies received capital stock in Eastern in proportion to the capital provided by them.

The refinery

The refinery processes crude oil through various heat, pressure, and chemical operations to extract as much gasoline from the crude as possible. Other products such as sulphur, kerosene, distillate fuels, and asphalt are produced as by-products. A certain quantity of fuel extracted from the crude is used to provide the heat necessary to operate the refinery as well as to provide heat and power for the refinery administrative and service support functions.

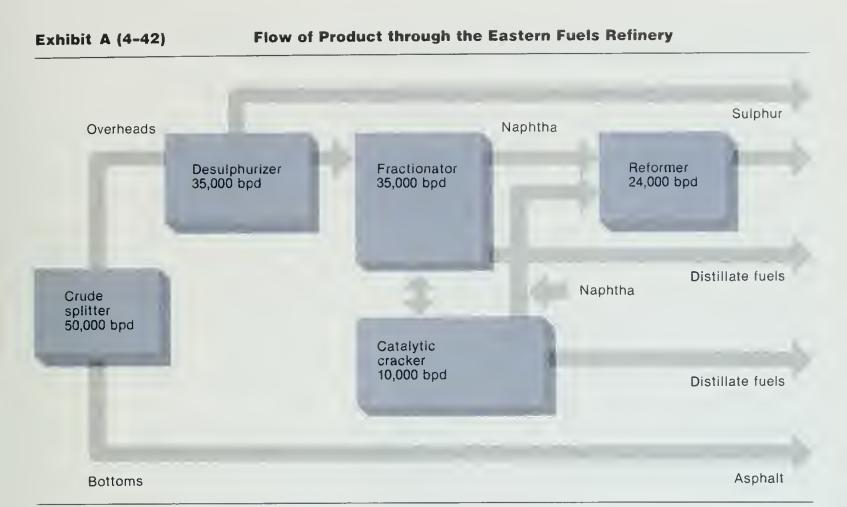

The original Eastern fuels refinery consisted of five principal processing units as diagrammed in Exhibit A. Crude oil was shipped to the refinery and piped to the crude splitter. This unit separates the crude oil into two products: (1) "overheads," which consist of the lighter fractions from the crude, and (2) "bottoms," which contain the heavier fractions. Bottoms have relatively little energy content and are sold as asphalt with very little further processing.

Overheads contain naphtha, a very light fraction; fuel oil, an intermediate prod- uct; and sulphur. The sulphur must be removed before the overheads can be pro- cessed into finished products. A desulphurization unit extracts the sulphur from the overheads. The remaining overhead flow is then distilled in the fractionator. The products with the lower boiling point (that is, the lighter fractions) vaporize as the temperature in the fractionator equals the boiling point of the respective fraction. The vaporized fractions are then cooled and return to their liquid state.

Naphtha, one of the lighter fractions, is used to make gasoline. With the use of heat and pressure in the reformer unit, naphtha is converted into gasoline. The remaining fractions are then directed to the catalytic cracker. This unit employs

chemical and heat processes to convert some of the heavier materials from the fractionator into the more valuable naphthas. The naphthas from the catalytic cracker are then processed through the reformer in the same manner as the naphthas from the fractionator. The remaining output from the catalytic cracker is sold as distillate fuel products (such as kerosene, jet fuel, and heating oil).

Refinery investment costs.

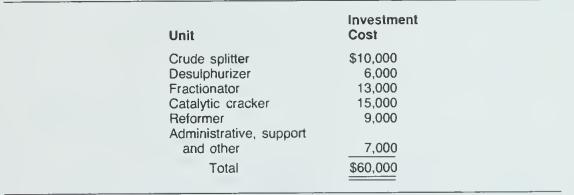

The costs to construct the initial refinery totaled $60 million. These initial costs were related to different units and support functions as follows (in thousands):

The sponsoring companies entered into a contract for the processing of crude oil through the refinery. Each sponsor was permitted to utilize the refinery capacity to process crude oil in the same ratio as their equity investment. Thus, American was

permitted to process 35,000 barrels per day (70 percent of 50,000 bpd capacity). The refinery acts as a processing service that receives the crude, processes it, and delivers the end products to each processor. To recover its costs, the refinery charges a processing fee to each of the sponsors. The processing fee consists of a variable charge based on the crude oil actually processed during a period plus a fixed charge based on the sponsor's share of refinery capacity.

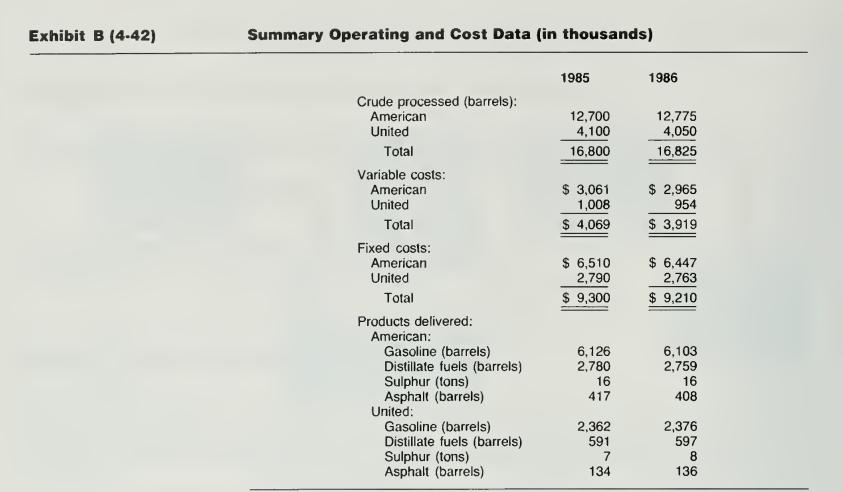

Certain operating and cost data related to refinery processing during the years 1985 and 1986 are shown in Exhibit B.

Expansion proposal

American had been utilizing close to its share of capacity for several years. Indeed, to supply all of its customers in the market area served by this refinery, it was necessary to import finished distillate fuels from other, distant refining facilities. On occasion, to supply its customers. American was required to purchase distillate fuels on the spot market.

As a result of market conditions, American's management proposed that parts of the Eastern refinery be expanded. The expansion would provide additional distillate fuels for American's local needs and, in addition, would provide naphthas that could be transported to another American refinery for further processing. There would be a net reduction in the company's transportation costs from savings in distillate fuels transportation. As a result of this, and by eliminating the need to make spot market purchases. American management estimated it could obtain net after-tax cash sav- ings of $2.5 million in each of the estimated 20 years' life of the refinery expansion. The return on investment for the project was quite high because the project could utilize the tankage, wharf, and piping systems already in place at the refinery site.

According to the agreement between the sponsors of Eastern, any sponsor could request that the refinery company construct an expansion or modification to increase the maximum capacity of the refinery. If one of the sponsors proposed an expansion. it had to advise the other sponsor of the nature of the project and the estimated investment costs of the project together with an estimate of the fixed costs that would arise from the expansion. The other sponsor could elect to join in the project or could decline. If this sponsor declined participation, the expansion could still be con- ducted, but all of the investment costs would then be charged to the sponsor that proposed the expansion.

The agreement between the sponsors further provided that any such expansion would become a part of the refinery but that the sponsor who financed the expansion would receive the exclusive right to use the expansion. In addition, appropriate adjustments were to be made to the accounting procedures to reflect the existence of the expansion and to make certain that neither party was adversely affected by the expansion. The definition of "appropriate adjustments" was not specified in the agreement.

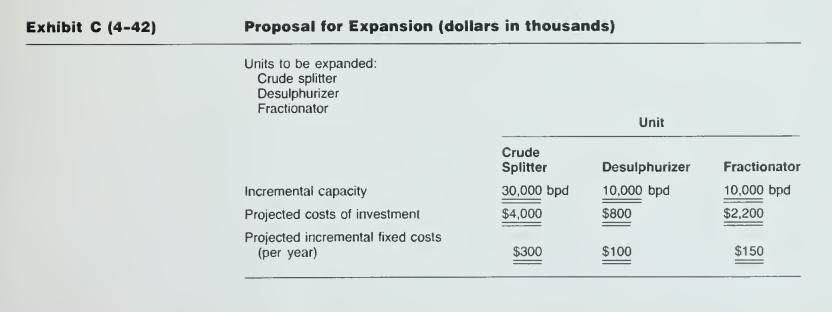

In 1985, American submitted a proposal to expand the crude splitter, de- sulphurizer, and fractionator. Summary data concerning the estimated differential costs, investment required, and capacity expansions for the units are shown in Exhibit C. Information concerning American's estimated cash savings from the project were not disclosed because those data are proprietary.

After reviewing the proposal. United notified Eastern that it did not wish to participate. United objected to Eastern's construction of the proposed expansion on the grounds that they would suffer a reduced ability to compete with American should American obtain the proposed additional ability to produce distillate fuels.

American agreed to finance all of the costs of the expansion. The expansion was constructed for the investment costs shown in Exhibit C. The new units were placed in service at the start of 1987.

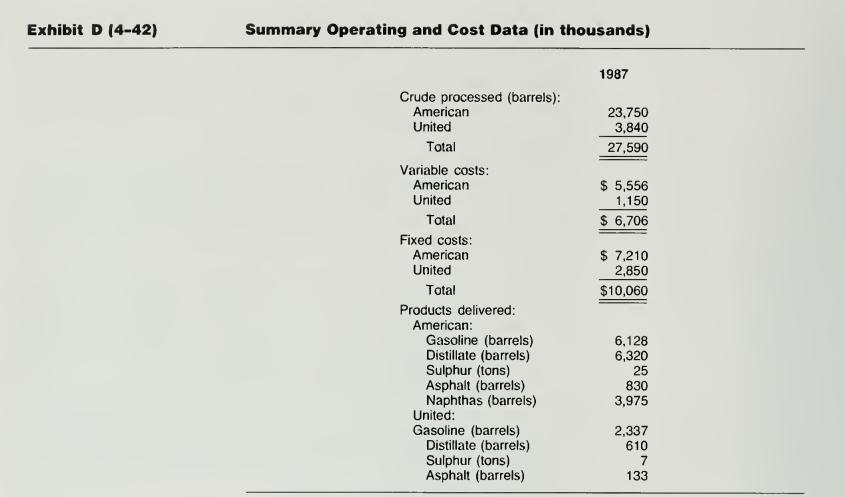

At the end of 1987, a report of operating and cost data was prepared. This report is reproduced in Exhibit D. The fixed costs included $9.5 million attributed to the original refinery plus $560.000 considered related to the expansion.

Upon receipt of this statement, United immediately objected to the allocation of fixed costs. In a memorandum to the board of directors of the refinery. United management stated:

As you know, we objected to the expansion of this refinery because we believed such an expansion was not in the best interest of the refinery and would be harmful to our competitive position in the local market.

Our agreement calls for the allocation of fixed costs on the basis of the maximum capacity of the Eastern refinery. Whereas we previously had 30 percent

of that maximum capacity and paid 30 percent of the fixed costs, we now only have 18.75 percent of that capacity. However, you have charged us 28.3 percent of the total fixed costs. Our share of the fixed costs should not exceed 18.75 percent, and we request an immediate adjustment to our account.

We note that under your allocation scheme our fixed costs per barrel amounted to $.74 this year, but the fixed costs allocated to American only amounted to $.30. This disparity clearly demonstrates that your method of allocation is incorrect.

Finally, it is apparent that the wharf and related facilities, which we helped construct, are being utilized to a much greater extent now that American is processing a greater share of the refinery throughput. We believe that American should be required to reimburse us for the difference between our 30 percent investment in the wharf and our usage, which this year only amounted to 13.9 percent.

We trust this matter can be resolved promptly at the next meeting of the board.

The chairman of the board of Eastern has directed this memorandum to the controller's office with the following comment:

The points raised in this letter will be discussed at next week's meeting of the board. It is imperative that we straighten this out at once. The points appear logical, and I hope that any error in your office can be corrected.

What is the amount by which they appear to have been overcharged? How would their method affect the economic viability of the expansion? What account- ing principles did you use in arriving at your method of allocation?

Required: The controller asked you to prepare a draft of a response to the chairman of the board together with any supporting schedules or documents that would be required. Your response would address each of the points raised in the letter from United..

Step by Step Answer: