Impact of Using Machine-Hours versus Labor- Hours for Allocating Overhead: Herbert Manufacturing Company manufactures custom-designed restaurant fur-

Question:

Impact of Using Machine-Hours versus Labor- Hours for Allocating Overhead: Herbert Manufacturing Company manufactures custom-designed restaurant fur- niture. Actual overhead costs incurred during the month are applied to the products on the basis of actual direct labor-hours required to produce the products. Overhead consists primarily of supervision, employee benefits, maintenance costs, property taxes, and depreciation.

Herbert Manufacturing recently won a contract to manufacture the furniture for a new fast-food chain. To produce this new line, Herbert Manufacturing must purchase more molded plastic parts for the furniture than for its current line. An efficient manufacturing process for this new furniture has been developed that requires only a minimum capital investment.

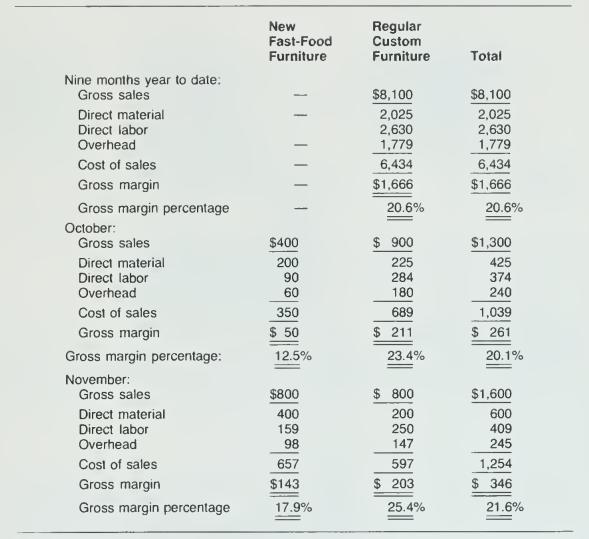

At the end of October, the start-up month for the new line, the controller prepared a separate income statement for the new product line. The profitability for the new line was less than expected. The president of the corporation is concerned that stockholders will criticize the decision to add this lower quality product line at a time when profitability appeared to be increasing with the regular product line.The results as published for the first nine months, for October, and for November are (in thousands):

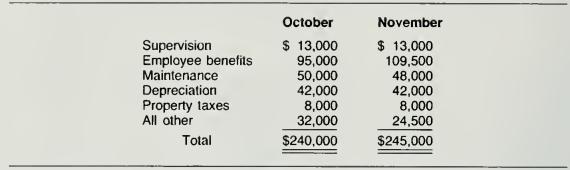

Ms. Jameson, cost accounting manager, stated that on the basis of a recently completed study of company overhead, she feels that only the supervision and employee benefits should be allocated on the basis of direct labor-hours. The balance of the overhead should be allocated on a machine-hour basis. In Jameson's judgment, the increase in the profitability of the custom-designed furniture is due to a misalloca- tion of overhead.

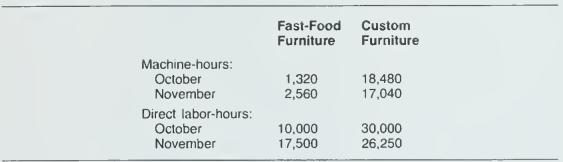

Actual direct labor-hours and machine-hours for the past two months are shown below.

Actual overhead costs for the past two months were:

Required:

a. Reallocate the overhead for October and November using direct labor-hours as the allocation base for supervision and employee benefits. Use machine- hours as the base for the remaining overhead costs.

b. Support or criticize the conclusion that the increase in custom-design prof- itability is due to a misallocation of overhead. Use the data developed in re- quirement

(a) to support your analysis.

Step by Step Answer: