Effect of Constraints on Investment Decisions: Carbondale and Company, a medical partnership, has $1.5 million available for

Question:

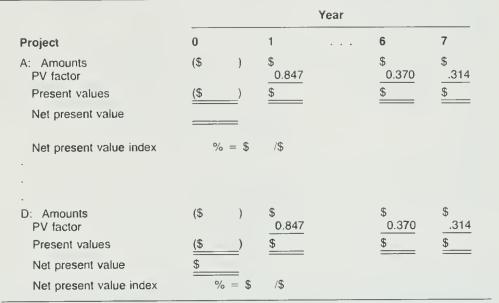

Effect of Constraints on Investment Decisions: Carbondale and Company, a medical partnership, has $1.5 million available for investment in venture capital projects. The cost of capital is 18 percent. As a partnership, Carbondale pays no income taxes. The following opportunity ventures are available. Each has an estimated seven-year life.

A. Software Designs, an innovative software development company, has requested $900,000. The firm estimates no returns until Year 5. Years 5 through 7 should return $1 million per year.

B. Sunset Mall, a new shopping center development, will cost Carbondale $550,000. The project will return $65,000 per year for each of Years 1-3 and $250,000 per year in Years 4-7.

C. Nutri-care, a health food chain, requires an investment of $650,000 to open a new store. This project will return $260,000 in each of Years 1-3 and $60,000 per year in Years 4-7.

D. Marvin Gardens, a housing development, would require $850,000 and return $250,000 in each of Years 1-7.

Required: Complete the following schedule (dollars in thousands) to:

a. Calculate the net present value index for each investment

b. Determine how the company can optimally invest its venture capital funds. Assume no other constraints on investment.

Step by Step Answer: