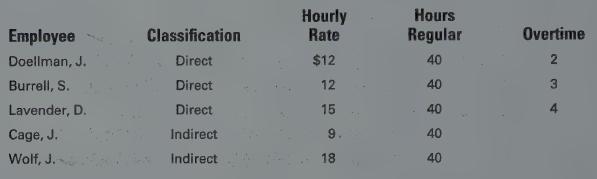

Employees' earnings and taxes A weekly payroll summary made from labor time records shows the following data

Question:

Employees' earnings and taxes A weekly payroll summary made from labor time records shows the following data for Musketeer Manufacturing Company:

Overtime is payable at one-and-a-half times the regular rate of pay for an employee and is distributed to all jobs worked on during the period.

a. Determine the net pay of each employee. The income taxes withheld for each employee amount to 15% of the gross wages.

b. Prepare journal entries for the following:

1. Recording the payroll.

2. Paying the payroll.

3. Distributing the payroll. (Assume that overtime premium will be charged to all jobs worked on during the period.)

4. The employer's payroll taxes. (Assume that none of the employees has achieved the maximum wage bases for FICA and unemployment taxes.)

Step by Step Answer: