Evaluate Capital Investment Cash Flows: Hammond Industries is a toy manufacturer that will have excess capacity at

Question:

Evaluate Capital Investment Cash Flows: Hammond Industries is a toy manufacturer that will have excess capacity at its single plant. Hammond's management is currently studying two alternative proposals that would utilize this excess capacity.

Proposal I Hammond has been approached by GloriToys, one of its competitors, to manufacture a partially completed doll. GloriToys, owner of the distribution rights for the doll, would finish the dolls in its plant and then market the dolls. The GloriToy doll would not compete directly with any of Hammond's products. GloriToys would contract to purchase 5,000 unfinished dolls each month at a price of $7.50 each for Years 1 through 4. Hammond's estimated incremental cash outlays to manufacture the doll would be $250,000 per year during the four-year contract period. In addition, this alternative would require a $400,000 investment in manufacturing equipment in Time 0. The equipment would have no salvage value at the end of its useful life.

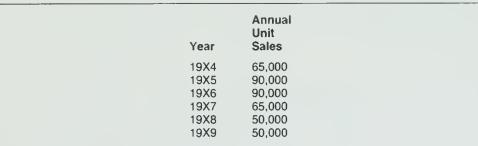

Proposal 2 Hammond is considering the production of a new stuffed toy to be added to its own product line. The new stuffed toy would be sold at $15 per unit, and the expected annual sales over the estimated six-year product life (19X4-19X9) for the toy is as follows:

The variable unit manufacturing and selling costs are estimated to be $6 and $1. respectively, over this six-year period. The estimated annual incremental cash outlay for fixed costs would be $300,000. The manufacture and sale of the new stuffed toy would require a $700,000 investment in new manufacturing equipment. This equip- ment would have a salvage value of $50,000 at the end of the six-year period. Additional information relative to a decision between the two proposals follows.

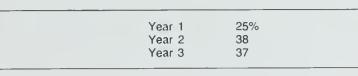

Manufacturing equipment for either proposal would be placed in service during December 19X3, Time 0. Depreciation on the equipment would be recognized starting in 19X4. The allowable tax deduction for depreciation is:

Hammond Industries is subject to a 30 percent income tax rate on all income.

Hammond's management assumes that annual cash flows occur at the end of the year for evaluating capital investment proposals. Hammond uses a 15 per- cent after-tax discount rate.

Required: Calculate the net present value at December 31, 19X3, of the estimated after-tax cash flows of Hammond Industries' proposal of:

a. Manufacturing unfinished dolls for GloriToys.

b. Manufacturing and selling a new stuffed toy to be added to its own product line.

Step by Step Answer: