Girth, Inc., makes two kinds of mens suede leather belts. Belt A is a high-quality belt, while

Question:

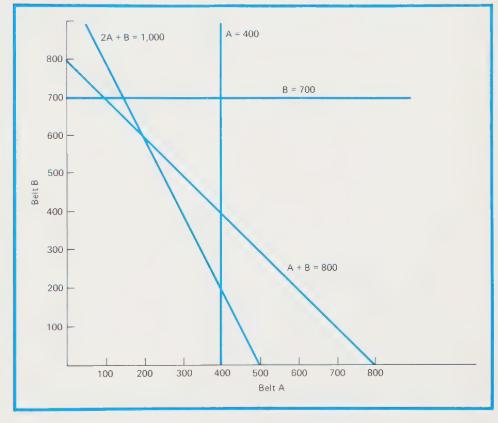

Girth, Inc., makes two kinds of men’s suede leather belts. Belt A is a high-quality belt, while belt is of somewhat lower quality. The company earns $7.00 for each unit of belt A that is sold, LINEAR and $2.00 for each unit sold of belt B. Each unit (belt) of type A requires twice as much manufacturing time as is required for a unit of type B. Further, if only belt type B is made, Girth has the capacity to manufacture 1,000 units per day. Suede leather is purchased by Girth under a longterm contract which makes available to Girth enough leather to make 800 belts per day (A and B combined). Belt A requires a fancy buckle, of which only 400 per day are available. Belt B requires a different (plain) buckle, of which 700 per day are available. The demand for the suede leather belts (A or B) is such that Girth can sell all that it produces.

The graph below displays the constraint functions based upon the facts presented above.369

Required:

a Using the graph, determine how many units of belt A and belt B should be produced to maximize daily profits.

b Assume the same facts above except that the sole supplier of buckles for belt A informs Girth, Inc., that it will be unable to supply more than 100 fancy buckles per day. How many units of each of the two belts should be produced each day to maximize profits?

c Assume the same facts as in b except that Texas Buckles, Inc., could supply Girth, Inc., with the additional fancy buckles it needs. The price would be $3.50 more than Girth, Inc., is paying for such buckles. How many, if any, fancy buckles should Girth, Inc., buy from Texas Buckles, Inc.? Explain how you determined your answer.

Step by Step Answer:

Cost Accounting Concepts And Applications For Managerial Decision Making

ISBN: 9780070103108

2nd Edition

Authors: Ralph S. Polimeni, James A. Cashin, Frank J. Fabozzi, Arthur H. Adelberg