The Frey Company manufactures and sells two productsa toddler bike and a toy high chair. Linear programming

Question:

The Frey Company manufactures and sells two products—a toddler bike and a toy high chair.

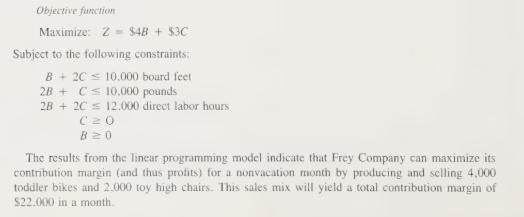

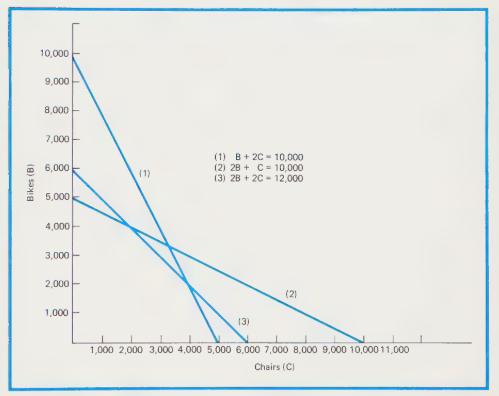

Linear programming is employed to determine the best production and sales mix of bikes and USING LINEAR chairs. This approach also allows Frey to speculate on economic changes. For example, management is often interested in knowing how variations in selling prices, resource costs, resource availabilities, and marketing strategies would affect the company’s performance.

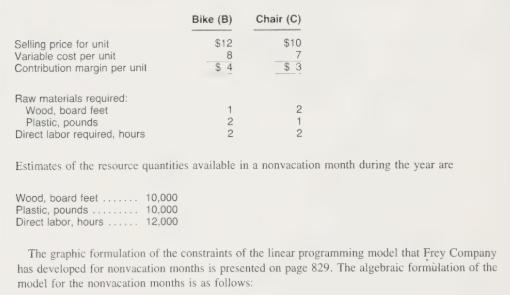

The demand for bikes and chairs is relatively constant throughout the year. The following economic data pertain to the two products: mkp852

Required:

a During the months of June, July, and August, the total direct labor hours available are reduced from 12,000 to 10,000 hours per month due to vacations.

1 What would be the best product mix and maximum total contribution margin when only 10,000 direct labor hours are available during a month?

2 The “‘shadow price’’ of a resource is defined as the marginal contribution of a resource or the rate at which profit would increase (decrease) if the amount of resource were increased (decreased). Based upon your solution for 1, what is the shadow price of direct labor hours in the original model for a nonvacation month?

b Competition in the toy market is very strong. Consequently, the prices of the two products tend to fluctuate. Can analysis of data from the linear programming model provide information to management which will indicate when price changes made to meet market conditions will alter the optimum product mix? Explain your answer.

Step by Step Answer:

Cost Accounting Concepts And Applications For Managerial Decision Making

ISBN: 9780070103108

2nd Edition

Authors: Ralph S. Polimeni, James A. Cashin, Frank J. Fabozzi, Arthur H. Adelberg