Incentive plan and payroll costs Schlikk Company uses an incentive plan for its pro- duction department which

Question:

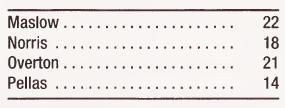

Incentive plan and payroll costs Schlikk Company uses an incentive plan for its pro- duction department which has 4 production employees. Base pay is $2 per unit produced with a standard of 20 units per day. The minimum wage is $30 regardless of production. A worker producing above 20 units a day earns a bonus of $.25 for all units produced that day. Production on Wednesday was as follows;

The company pays 7 percent of payroll for FICA tax, .7 percent for FUTA tax, 2.7 percent for SUTA, and 1.2 percent for workers' compensation, and 8 percent of the minimum wage for a guaranteed wage plan. Twenty percent of payroll is withheld for federal income taxes, and $1 per day for union dues for each employee.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: