Interaction of State Taxes and Contract Costs: Ark Fla, Inc., has two operating divisions. Fla Division operates

Question:

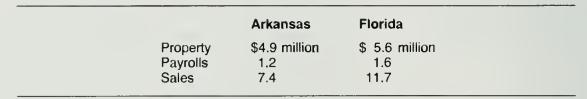

Interaction of State Taxes and Contract Costs: Ark Fla, Inc., has two operating divisions. Fla Division operates entirely in Florida and is engaged exclusively in the manufacture and sale of commercial products. Ark Division operates exclusively in Arkansas and is engaged in the manufacture of military equipment. Prior to receiving a new defense contract, Ark Fla, Inc., had the following distribution of property, payrolls, and sales between the two states:

Total income was $3 million. Ark Fla received a government contract that required the addition of $1 million in property in Arkansas. Payroll in Arkansas was increased by $.9 million, and sales increased by $3.1 million. The contract added $300,000 to income. Florida levies its 6 percent state income tax using the property, payrolls, and sales factors. No other elements in the factors for either state changed.

Required: What effect, if any, did the defense contract have on the Florida tax liability?

Step by Step Answer: