Job Costing with Service Department Cost Allocations: WX Service Company operates a job shop with two producing

Question:

Job Costing with Service Department Cost Allocations: WX Service Company operates a job shop with two producing departments: Department A and Department B. Jobs are started in Department A and then moved to Department B. When the work is finished in Department B, the jobs are immediately sold. The company also has two service Departments, W and X, which perform support services for the producing departments. In addition, Departments W and X perform services for each other.

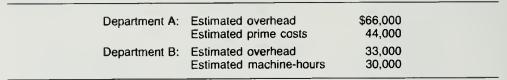

Overhead in Department A is applied to jobs on the basis of prime costs (that is, total direct materials and direct labor). Overhead in Department B is applied on the basis of machine-hours. For this period, the estimated overhead and estimated activity levels for applying overhead were as follows:

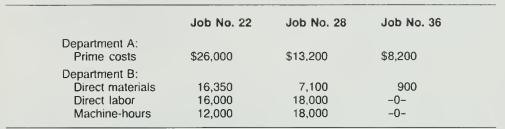

During the month, direct materials and direct labor costs were incurred on jobs as follows:

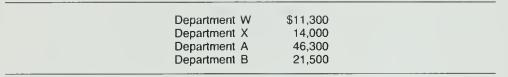

The balances of other departmental costs in the accounts for the service and producing departments (before allocation of service department costs) are as follows:

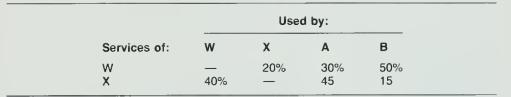

The use of services by other departments was as follows:

The company uses the step method for service cost allocation. Jobs No. 22 and No. 28 were completed during the period and were sold. Job No. 36 is in department B.

Required:

a. What was the current period cost on Job Nos. 22 and 28 that was transferred to cost of goods sold?

b. If actual overhead had been charged to Job No. 28, what amount of current period costs would have been transferred to cost of goods sold for that job?

Step by Step Answer: