Linear programming in a service firm The Last National Bank is evaluating its portfolio of loans in

Question:

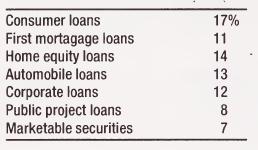

Linear programming in a service firm The Last National Bank is evaluating its portfolio of loans in an effort to develop an optimum loan strategy. Analysis of returns by loan category for the last two years reveals the following average returns:

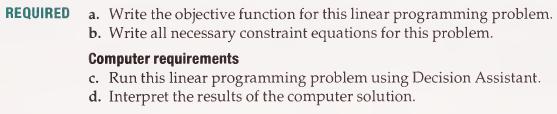

The bank has $50,000,000 in loanable funds. The bank has a policy of designating 12 percent of its available loan funds for public projects. No loan category can account for more than 25 percent of the bank's loanable funds. Regulatory requirements mandate a minimum of 5 percent of loanable funds be invested in marketable securities. Real estate loans combined cannot exceed 30 percent of loanable funds. No loan category can have less than 10 percent of loanable funds.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: