Make or buy decision analysis When you had completed your audit of The Scoopa Company, management asked

Question:

Make or buy decision analysis When you had completed your audit of The Scoopa Company, management asked for your assistance in arriving at a decision whether to continue manufacturing a part or to buy it from an outside supplier. The part, which is named Faktron, is a component used in some of the finished products of the company.

From your audit working papers and from further investigation you develop the following data as being typical of the company's operations:

1. The annual requirement for Faktrons is 5,000 units. The lowest quotation from a supplier was $8.00 per unit.

2. Faktrons have been manufactured in the precision machinery department. If Faktrons are purchased from an outside supplier, certain machinery will be sold for its book value.

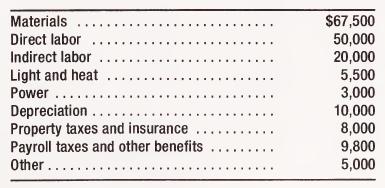

3. Following are the total costs of the precision machinery department during the year under audit when 5,000 Faktrons were made:

4. The following precision machinery department costs apply to the manufacture of Faktrons: material, $17,500; direct labor, $28,000; indirect labor, $6,000; power, $300, other, $500. The sale of the equipment used for Faktrons would reduce the following costs by the amounts indicated: depreciation, $2,000; property taxes and insurance, $1,000.

5. The following additional precision machinery department costs would be incurred if Faktrons were purchased from an outside supplier: freight, $.50 per unit; indirect labor for receiving, materials handling, inspection, etc., $5,000. The cost of the purchased Faktrons would be considered a precision machinery department cost.

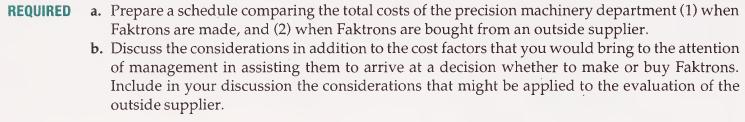

Step by Step Answer: