Making a decision to add or drop a product. The income statement for the McCartney Manufacturing Company

Question:

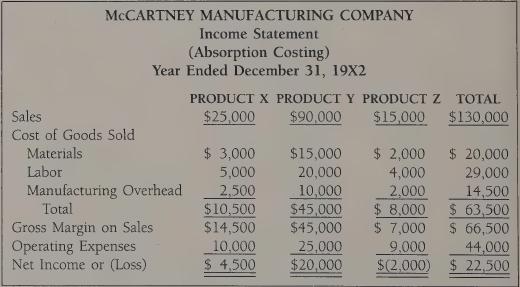

Making a decision to add or drop a product. The income statement for the McCartney Manufacturing Company is shown below. Management is concerned over the loss on Product Z.

Materials and labor are variable costs. Manufacturing overhead is applied at 50 percent of the direct labor cost. Variable overhead is 10 percent of the direct labor cost. Fixed overhead totals $11,600 per year. Variable operating expenses are 20 percent of the sales dollars. Fixed operating expenses total $18,000. The fixed overhead costs and operating expenses are expected to continue if Product Z is dropped.

Instructions 1. Prepare an income statement using direct costing to show the effects of retaining Product Z. You must first compute the variable manufacturing costs by product.

2. Prepare an income statement using direct costing to show the effects of dropping Product Z.

3. Explain what decision should be made and why.

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock