Multiple product CVP analysis Diane Britener is the sole shareholder and president of Britener Lighting, Inc., a

Question:

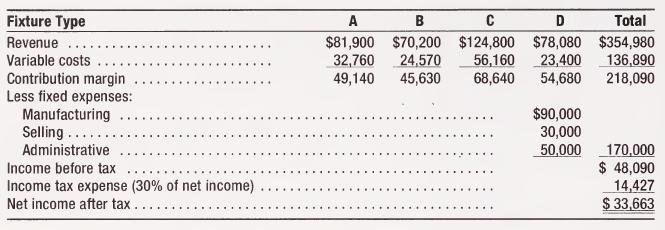

Multiple product CVP analysis Diane Britener is the sole shareholder and president of Britener Lighting, Inc., a small company that manufactures lighting fixtures. At the end of the current year she is examining the following income statement, which details the results of producing and selling the four types of fixtures that the company makes.

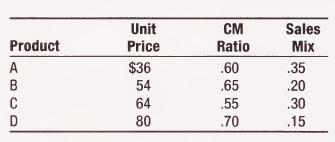

Diane is not especially satisfied with the net income, since she receives a very small salary from the company and depends on the income for her livelihood. The store manager, however, pointed out that the net income is 9.5 percent of sales, which is an excellent return for the company, since it operates in a highly competitive industry. "'We are actually very efficient," she says, "and it would be pretty hard to find any place to cut costs." Diane thought it may be possible to increase sales and started making calculations. She came up with the following figures when total sales are 6,500 units.

"The fixture with the highest contribution margin has the lowest proportion of sales," said Diane. "Let's see what we can do about that." She called in the company's sales representative and production supervisor to discuss the problem.

The sales representative pointed out that it would be very difficult to sell more of item D, because of its price. "The competition has similar units selling for less than $80," he said. "To increase sales of D you would have to lower the price to about $75. On the other hand, unit C could stand a slight price increase. Add $1.50 to the price of C and reduce the price of D by $5. That should change the sales mix to 25 percent C and 20 percent D."

The production supervisor said, "If you cut the price of D, you can't expect a cut in cost. The only unit on which we can save something is A. There is a plastic bracket available that we can use in place of the metal one we use now. It's internal so there is no change in appearance, but it can save you $.70 per unit."

The sales representative suggested hiring another representative, but both the owner and the manager thought it would be too costly to open a new territory. "We would have to almost double sales, and we are working at 80 percent capacity now. But I have looked into a new advertising campaign that would cost $10,000 per year and should increase sales in our current territory."

"The most you can expect is an increase of 500 units," said the sales representative. "My territory just cannot accept more. I can use the help but $10,000 may be too much for just 500 units of sales."

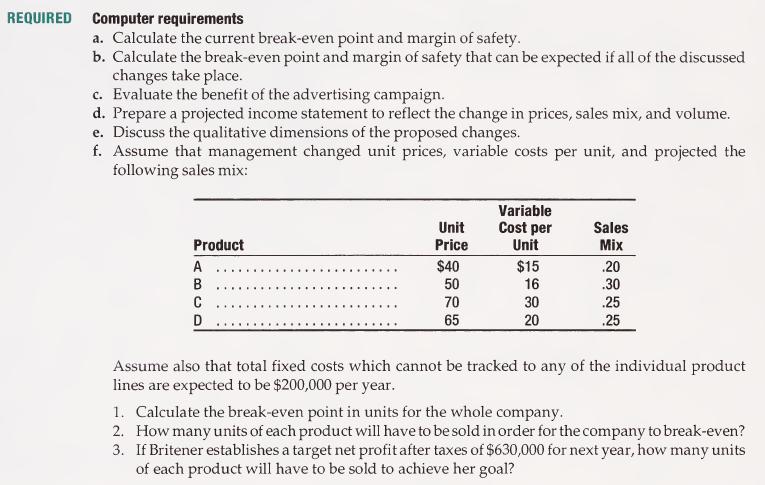

The manager replies, "We can look into it. To summarize, we seem to have the following options;"

Decrease price of D by $5 and increase sales mix to 20 percent.

Increase price of C by $1.50 and decrease sales mix to 25 percent.

Decrease variable cost of A by $.70 with no change in sales mix.

Increase sales by 500 units by increasing fixed cost $10,000.

The decision was made to evaluate the results of the above changes then meet again to discuss the projections.

Step by Step Answer: