Payment and distribution of payroll. Similar to self-study problem. Lo 3 The general ledger of Jefferson Company

Question:

Payment and distribution of payroll. Similar to self-study problem.

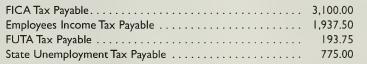

Lo3 The general ledger of Jefferson Company showed the following credit balances on May 1 5:

Direct labor earnings amounted to $10,500 from May 16 to May 31. Indirect labor was $5,700 and sales and administrative salaries for the same period amounted to $3,800. All wages are subject to FICA, FUTA, state unemployment taxes, and 10% income tax withholding.

Required:

1. Prepare the journal entries for the following:

a. Recording the payroll.

b. Paying the payroll.

c. Recording the employer's payroll tax liability.

d. Distributing the payroll costs for May 16 to 31.

2. Prepare the journal entry to record the payment of the amounts due for the month for FICA and income tax withholdings.

3. Calculate the amount of total earnings for the period from May I to May 15.

Step by Step Answer: