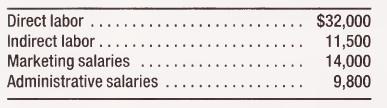

Payroll and payroll costs Following are the August payroll data for Sabul Company: The FICA tax rate

Question:

Payroll and payroll costs Following are the August payroll data for Sabul Company:

The FICA tax rate on employees and employers is 7 percent of pay. Workers' compensation is .06 percent. Only $11,000 of direct labor and $5,000 of indirect labor is subject to FUTA of .8 percent and state unemployment insurance of .9 percent. Federal income taxes to be withheld amount to $14,200. There is no state income tax.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: